S&P 500: Headlines vs. Reality – Staying Focused on the Uptrend | Episode 283

By Jason McIntosh | 31 January 2025

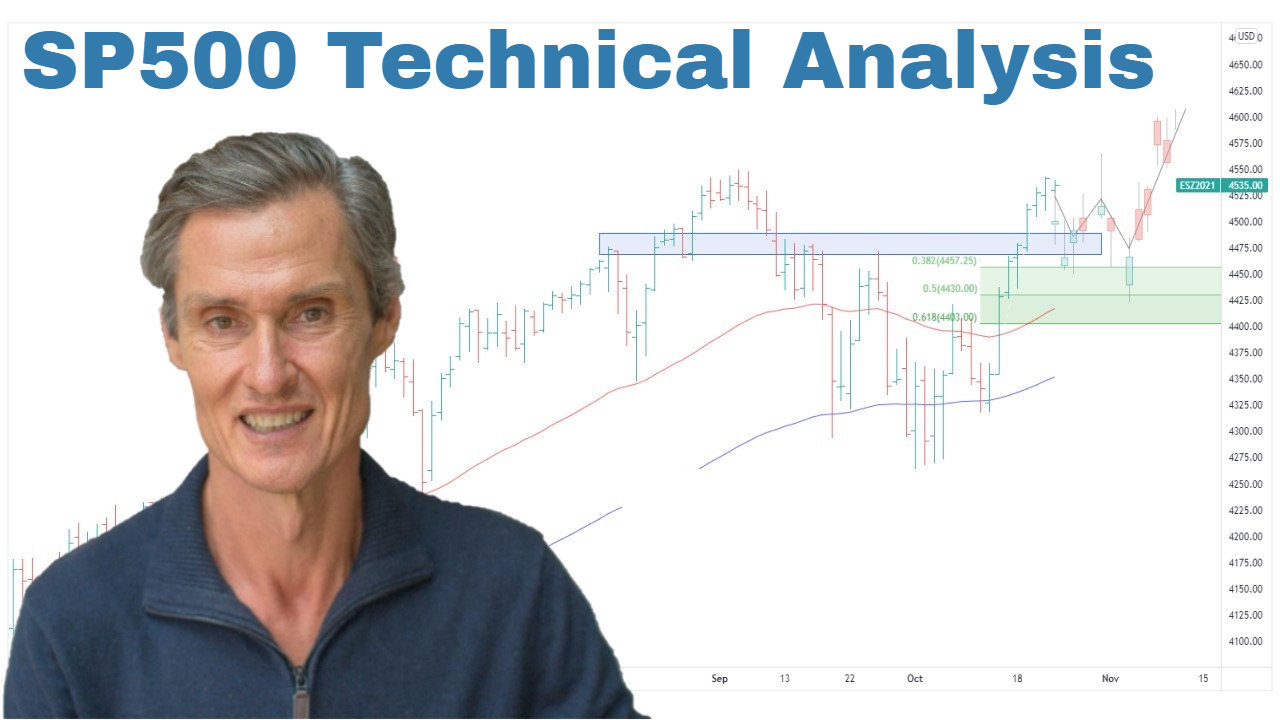

The S&P 500 has experienced an eventful few days, reaching a new all-time high on Friday, only to see a sharp 2-2.5% sell-off on Monday. The Nasdaq saw an even larger intraday swing of 4.5% before stabilising. The catalyst? Concerns about Chinese AI advancements and their potential impact on the valuations of US tech stocks, particularly Nvidia.

While headlines have been dramatic, the real question for investors is: Has the market structure actually changed? Let’s break down what’s happening and how to navigate the current environment.

Short-Term Shock, Long-Term Uptrend

Despite the volatility, the bigger picture remains unchanged. The S&P 500 is still above its rising 50-day and 100-day moving averages, a strong indicator of an ongoing uptrend.

Key Observations:

- Sell-offs create headlines but don’t always change trends: Monday’s decline was widely covered in the media, but one or two days of negative news isn’t enough to reverse a long-established trend.

- Buying the dip remains in play: Price action suggests early signs of dip-buying, reinforcing that investor sentiment is still constructive.

- No confirmed breakdown: While consolidation or further volatility is possible, there’s no indication that the S&P 500 is shifting into a downtrend.

Equal-Weighted Index: A Reality Check

While the market-cap weighted S&P 500 fell sharply due to tech giants like Nvidia (-20%), Microsoft, and Apple, the equal-weighted S&P 500 barely moved.

What This Tells Us:

- The broader market remains healthy: A select few large stocks drove Monday’s drop, but most stocks didn’t experience the same level of weakness.

- Market breadth is improving: The participation of more stocks in the rally suggests a strengthening trend, not a weakening one.

Understanding Nvidia’s Impact

Nvidia’s 20% decline on Monday played a major role in dragging the index down. Given that Nvidia represents 6.5% of the S&P 500, such a big move can create misleading signals about broader market weakness.

This is why tracking the equal-weighted S&P 500 is crucial—it can help provide a more accurate view of the overall market, rather than just following the movement of a few mega-cap stocks.

How to Navigate This Market

- Stay Aligned with the Trend: The S&P 500 remains in an uptrend, so the focus should remain on stocks that continue to show strong momentum.

- Use Trailing Stops to Manage Risk: Volatility can spike at any time. Wide trailing stops help lock in gains while allowing positions to run.

- Monitor Market Breadth: The increasing number of stocks trading above their 100-day moving averages is a positive sign that the rally is broadening.

- Avoid Emotional Trading: Reacting to headlines without considering the bigger picture can lead to poor investment decisions.

Key Takeaways for Investors

- Headlines create short-term reactions, but the trend remains up.

- Equal-weighted S&P 500 shows that most stocks were stable despite the index’s decline.

- Nvidia’s sharp drop exaggerated Monday’s sell-off, but broader market strength remains.

- Use wide trailing stops to stay on trends while protecting against reversals.

Final Thoughts

While Monday’s sell-off generated plenty of noise, the underlying trend remains intact. The S&P 500 continues to trade above its key moving averages, with dip-buying interest evident. The market’s path of least resistance remains higher, and disciplined investors should continue focusing on the trend while managing risk effectively.

At Motion Trader, we help investors navigate volatility with a systematic, rules-based approach that prioritises trend-following and risk management. Stay focused, disciplined, and prepared — markets reward those who stay on the right side of the trend.

👉 Want to stay ahead of market trends? Join our Weekly Strategy Sessions.

Looking for the best ASX stocks to buy now?

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

Video Links

For reference to the topics discussed:

09:20 Is this week’s SP500 sell-off about to get worse?

11:20 Many people fall for this common trap (don’t be one of them!)

12:50 Forget the headlines: Make sure you know THIS

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).