By Jason McIntosh | 11 April 2025 ASX 200: Volatility Hits New Extremes After a two-week reprieve, volatility stormed back into the Australian market. Monday’s sharp sell-off has now made this the most volatile period for the ASX 200 since the COVID crash in 2020. Key Developments: Oversold Indicator: Using our trusted percentage below 50-day […]

By Jason McIntosh | 4 April 2025 📊 ASX 200: Sharp Reversal Signals Caution After a brief two-week reprieve, volatility is back — and in a big way. Key Support in Focus Technical Indicator Watch Strategy Learn how to use trailing stops effectively → 🌐 S&P 500: Worst Daily Drop in Nearly Five Years The […]

By Jason McIntosh | 26 March 2025 ASX 200: A Tentative Recovery Beneath Key Averages The ASX 200 is on track for a second consecutive positive week—something we haven’t seen since early February. While a rebound is welcome, it comes against a backdrop of declining 50- and 100-day moving averages. That begs the question: Is […]

By Jason McIntosh | 21 February 2025 ASX 200 and S&P 500 Weekly Technical Analysis Extreme Moves, Rebounds, and What Could Be Next Both the ASX 200 and the S&P 500 have seen significant action this week. Sharp declines over the past month are now followed by rebounds that are raising more questions than answers. […]

By Jason McIntosh | 14 February 2025 📈 Global Market Wrap: ASX 200 & S&P 500 at Crucial Turning Points Why history says this sell-off might be an opportunity… and how to prepare for what’s next. 🔹 Key Points at a Glance 🇦🇺 ASX 200: Testing Critical Support Levels The ASX 200 has just wrapped […]

By Jason McIntosh | 24 January 2025 The ASX 200 has reached a new all-time high for 2025, continuing its 14-month bullish trend despite recent market pullbacks. While short-term declines often spark fear among investors, history shows that these pullbacks are typically part of a larger uptrend. With strong buying interest and supportive technical indicators, […]

By Jason McIntosh | 31 January 2025 The S&P 500 has experienced an eventful few days, reaching a new all-time high on Friday, only to see a sharp 2-2.5% sell-off on Monday. The Nasdaq saw an even larger intraday swing of 4.5% before stabilising. The catalyst? Concerns about Chinese AI advancements and their potential impact […]

By Jason McIntosh | 24 January 2025 The ASX 200 has remained relatively stable this week, showing less than a 1% change from last Friday. However, beneath the surface, significant developments suggest the market’s bullish trend is gaining strength. Let’s dive into the latest insights, explore technical signals, and outline strategies to navigate this evolving […]

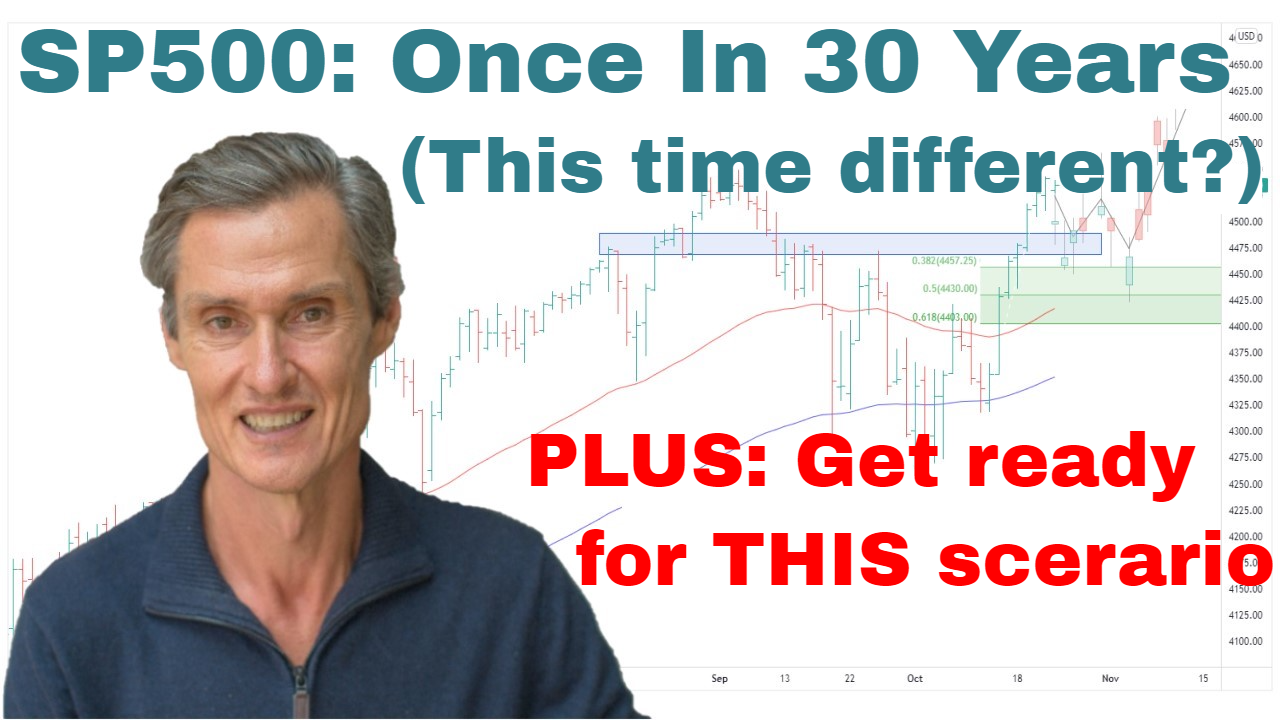

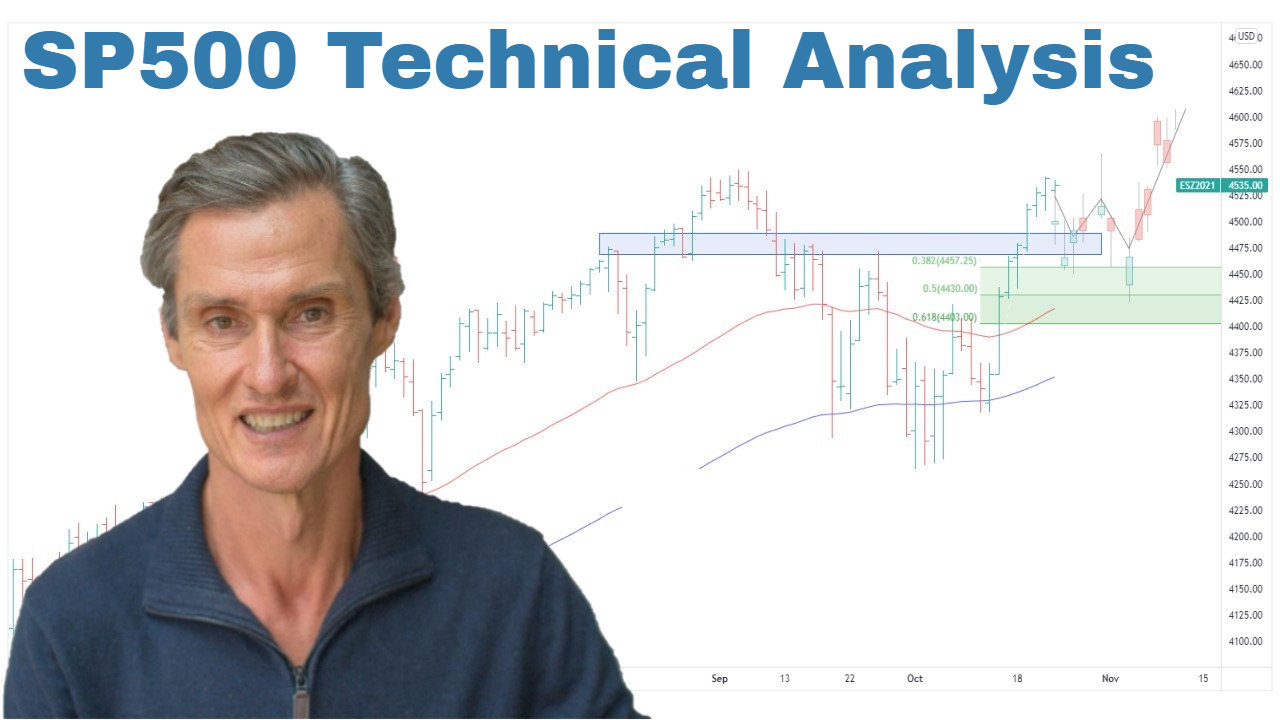

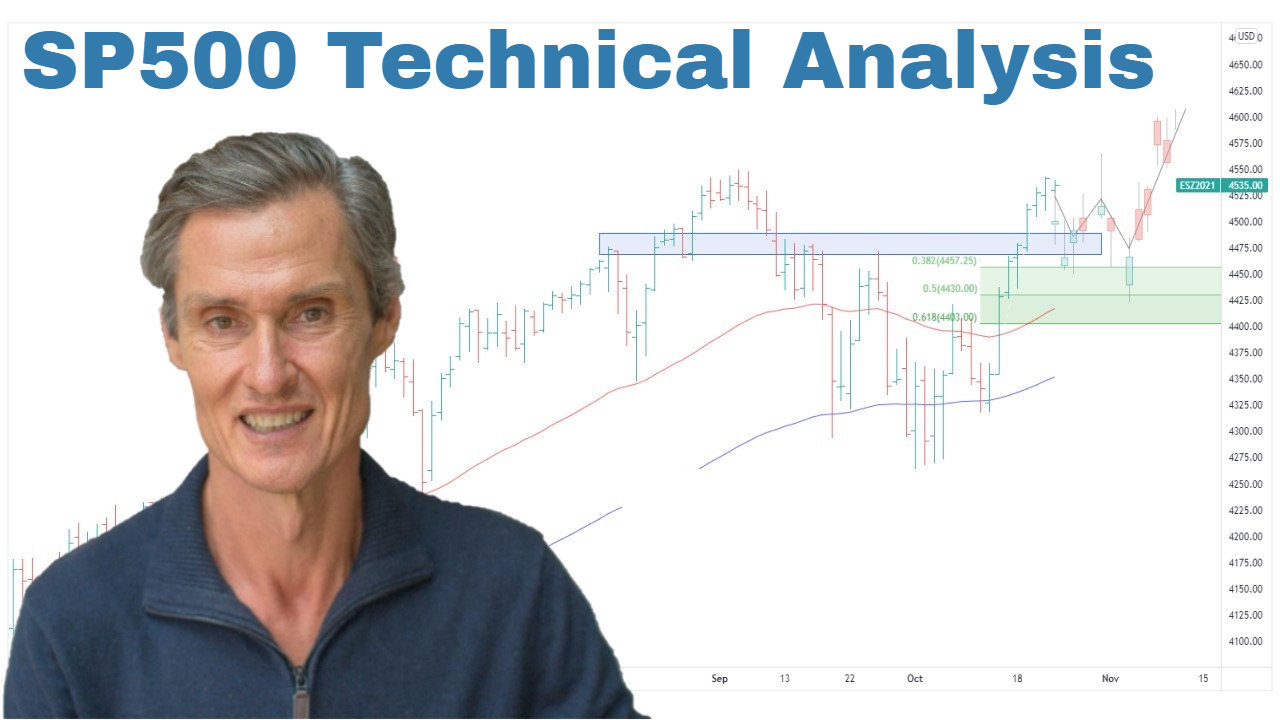

By Jason McIntosh | 24 January 2025 The S&P 500 has continued to surprise investors, with a recent false breakout quickly giving way to a rally that propelled the index to new all-time highs. While the broader market shows improving participation, underlying divergence in the equal-weighted index remains a point to watch. Let’s break down […]

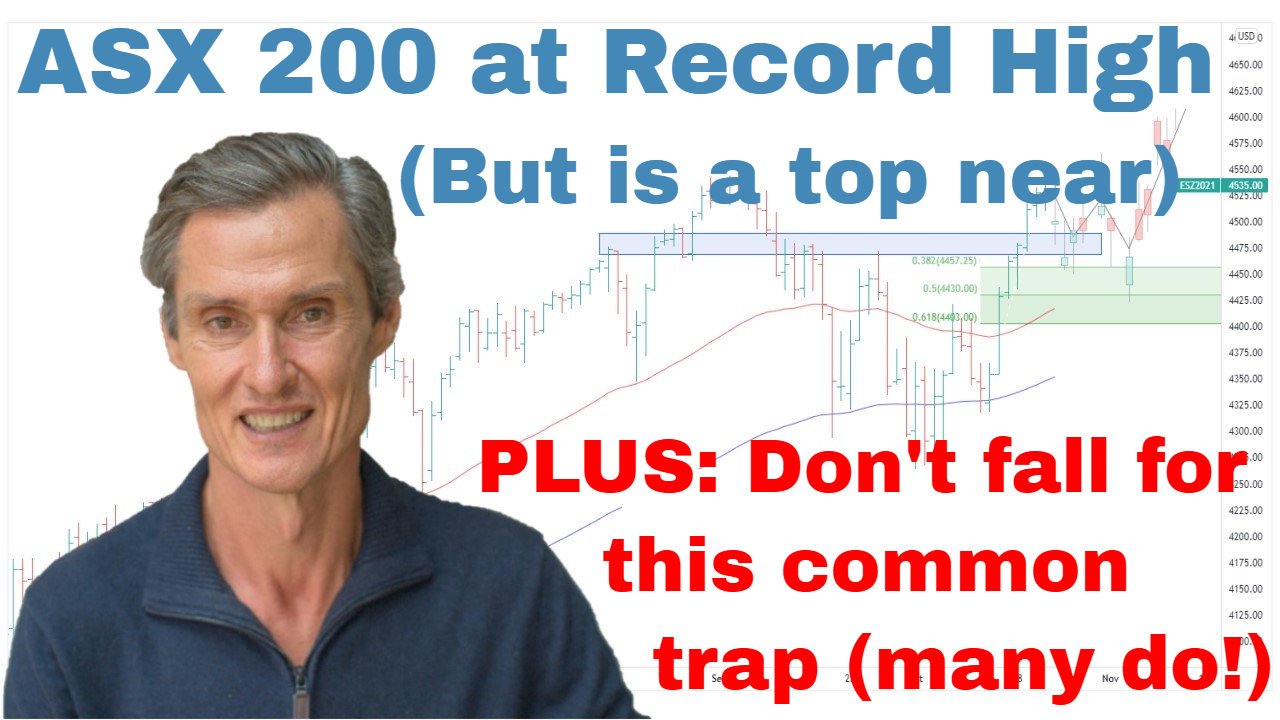

By Jason McIntosh | 17 January 2025 The ASX 200 is at an intriguing juncture, with signs of potential topping patterns emerging alongside continued bullish momentum. Investors face conflicting signals, making this a critical period for careful portfolio management. Let’s explore the latest technical developments, sector insights, and strategies to navigate the evolving market environment. […]