S&P 500: Riding the Trend Amid False Breakouts and Divergence | Episode 281

By Jason McIntosh | 24 January 2025

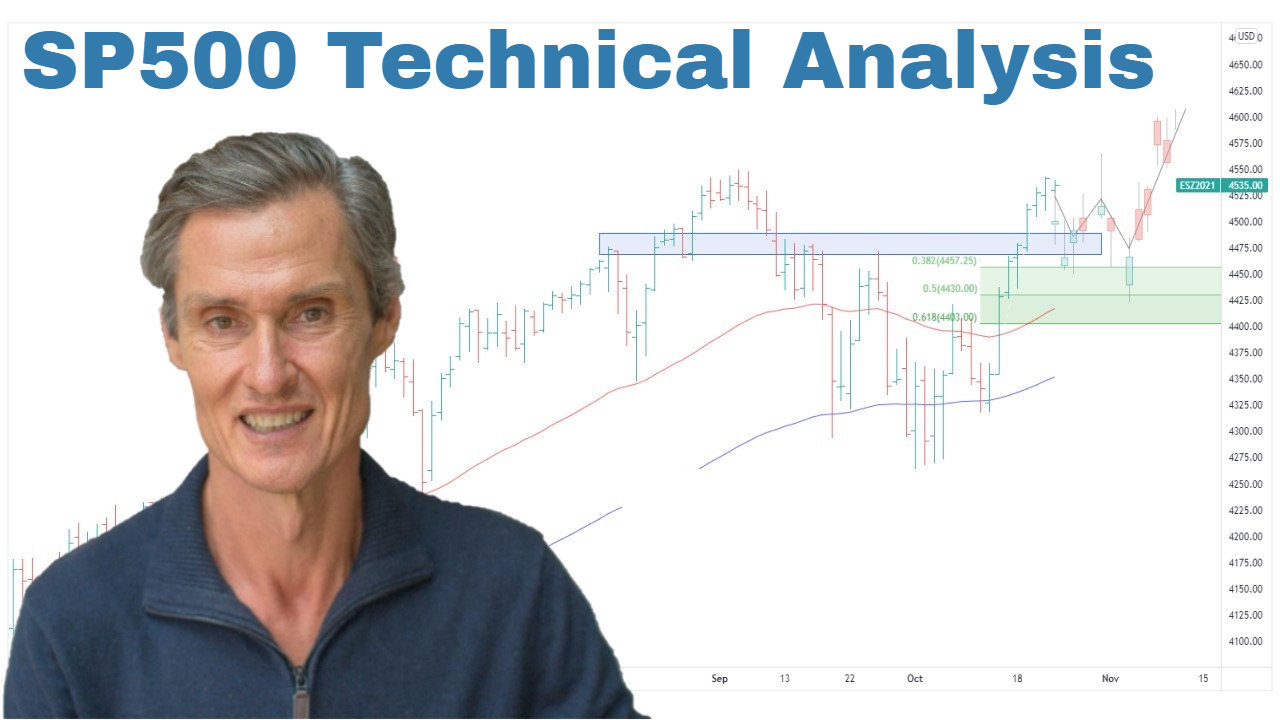

The S&P 500 has continued to surprise investors, with a recent false breakout quickly giving way to a rally that propelled the index to new all-time highs. While the broader market shows improving participation, underlying divergence in the equal-weighted index remains a point to watch.

Let’s break down the latest developments, explore the technical signals, and outline strategies for navigating this evolving market environment.

False Breakout: A Bullish Signal

Two weeks ago, the S&P 500 formed a coiling pattern near its moving averages, a textbook bullish setup. However, the market initially broke to the downside, only to rebound sharply back into the range and rally to new highs.

What We Can Learn from False Breakouts:

- Rejection of Selling Pressure: The failed breakdown highlights that selling pressure wasn’t as strong as feared, with buyers stepping in to drive prices higher.

- Confirmation of Upward Momentum: False breaks often signal that the path of least resistance remains to the upside, as seen in the current rally.

This type of price action underscores the importance of staying flexible and using technical signals to guide decisions.

A Textbook Uptrend

The S&P 500 continues to exhibit characteristics of a strong, sustained uptrend, with dips being bought and prices rallying off the moving averages.

Key Observations:

- Recurring Patterns: Similar price action occurred in April, August, and September 2024, with prices consolidating near the moving averages before resuming their upward trajectory.

- Trailing Stops for Risk Management: Staying with the trend and using trailing stops to manage risk is crucial, as predicting market tops can lead to missed opportunities.

The focus remains on maximizing time in trends, as this is often where the most significant gains are made.

Equal-Weighted Index: Signs of Recovery

While the market-cap-weighted S&P 500 reached new highs, the equal-weighted index showed earlier signs of vulnerability. Prices had been consolidating below rolling moving averages, with fewer stocks participating in the rally.

Encouraging Developments:

- Increased Participation: The percentage of S&P 500 stocks above their 100-day moving average has risen from 29% to 52% in recent weeks, signaling broader market strength.

- Closing the Window of Vulnerability: The recent rally has reduced the risk of further declines in the equal-weighted index, reinforcing the overall bullish trend.

Divergence: A Risk to Watch

Despite the improvements, divergence remains between the S&P 500 and its equal-weight counterpart, as the latter hasn’t yet reached a new high.

Key Considerations:

- Temporary Concern: Divergence can signal potential weakness, but it often resolves if the broader trend continues higher.

- Focus on the Primary Trend: With momentum returning and the S&P 500 leading the way, the overarching upward trend remains the priority for portfolio positioning.

Strategies for Navigating This Market

- Stay Flexible: Adjust your portfolio to align with the prevailing trend, scaling exposure up or down as conditions evolve.

- Use Trailing Stops: Protect gains and manage risk by employing trailing stops on profitable positions.

- Monitor Participation: Keep an eye on indicators like the percentage of stocks above their 100-day moving averages to gauge market breadth.

- Focus on the Trend: Avoid being swayed by temporary divergence and instead prioritize the established upward momentum.

Key Takeaways for Investors

- False Breakouts Are Insightful: The recent false breakout highlights strong buying interest and reinforces the bullish trend.

- Improved Market Participation: More stocks are now joining the rally, reducing earlier concerns about the market’s breadth.

- Stay Disciplined: Using trailing stops and focusing on the broader trend helps investors stay on track during periods of uncertainty.

Final Thoughts

The S&P 500’s resilience and new all-time highs reaffirm the importance of staying with the trend. While divergence in the equal-weighted index is a factor to watch, the broader upward momentum suggests a “risk-on” phase is re-emerging. By remaining flexible and disciplined, investors can navigate the opportunities and challenges of this dynamic market environment.

At Motion Trader, we emphasise systematic, rules-based strategies to help investors make informed decisions in all market conditions. Whether markets are trending higher or showing signs of divergence, our approach focuses on minimizing risk and maximizing opportunities.

👉 Want to stay ahead of market trends? Join our Weekly Strategy Sessions.

Looking for the best ASX stocks to buy now?

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

Video Links

For reference to the topics discussed:

07:40 SP500 catches out many traders (what you can learn)

10:00 Can you see this textbook pattern repeating?

10:40 This is how the BIG money is made

11:30 Two key risks (and what just changed)

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).