How to Invest in a Bear Market | 4 Must Know Rules

By Jason McIntosh | Published 23 May 2022

Lots of people ask how they should invest during a bear market. And that’s not surprising. Bear markets are the hardest part of the stock market cycle, and they can be an emotional nightmare.

So, how should you handle a bear market?

Well, that’s what I’m going to tell you in this article. The rules you’ll learn can help you manage your share portfolio in a bear market and help ensure you come out the other side.

What exactly is a bear market?

The definition of a bear market is a market that’s down by at least 20% from its high. Bear markets can last anywhere from a few months to over a year. The average length of a bear market is close to 10 months, while the average bull market lasts nearly three years.

Since 1945, there have been 14 bear markets. And the average frequency has been one about every five years. They are a normal part of the stock market cycle, and counterbalance the previous bull market. But despite being normal, bear markets can be a difficult period for investors. The average decline during a bear market is around 36%. You can get more bear market stats here.

What should you do in a bear market?

Okay, here’s my first big rule:

#1 Know what’s in your portfolio and know why it’s in there

Maybe you bought a stock for fundamental reasons, or maybe you liked the technical set-up, or perhaps it was a mix of both. No matter how a stock got into your portfolio, you need to ask whether the reason you bought it is still valid. And if it’s not, then ask yourself: Would I want to buy that same stock today?

If the answer is no, then it may be time to consider selling.

I’ll show you an example of what I mean by this. I’m going to show you a stock from my own portfolio. It’s a company called iCandy Interactive [ASX:ICI].

Here’s the chart:

iCandy is an interesting stock. It’s a small speculative company that develops video games. My entry was due to a technical set-up (first blue circle). The moving averages had turned higher, and the shares were breaking upwards. There was an initial strong run, and then the stocks started moving sideways.

From my perspective, that was all okay. You see, I’m targeting medium-term trends, and it’s normal for a stock to consolidate after a big move, and then continue higher. But when iCandy’s shares broke back below my entry point, it was time to sell (second blue circle).

You see, the reason for owning the stock was no longer there. I bought based on a breakout. And I was happy to sit with the consolidation. But holding as the stock was breaking below my entry price didn’t make sense, so I sold. The stock was quickly down another 25%.

So, that’s rule number one, in a bear market. If you don’t have a good reason for holding a stock, make sure you get out. There’s no point having a stock like iCandy stay in your portfolio and continue to deteriorate once your reason for owning it is no longer in place.

All right, let’s move to the next rule. And this is a big one.

#2 Don’t average down in individual stocks

Now, I just want to differentiate this from people who dollar cost average into an index fund. That can be a great longer-term way to grow wealth. Staying with an index over time and regularly add to your investment can be a rewarding approach.

But individual stocks are a completely different proposition. And that’s because an individual stock can go to zero. Individual stocks bring a lot of extra risk to the table. Averaging down into individual stocks can be one of the worst strategies for the everyday investor. It’s a dangerous strategy. And the way a lot of people apply it, it’s more of a gambling strategy than one that accumulates wealth over the longer term.

Averaging down has even ruined banks. Barings Bank in the 1990s was bankrupted by an averaging down strategy which combined leverage, which is even a worse way to approach your trading account. And it’s also wreaked havoc with so many individuals over the years.

Why do people average down?

A big reason people average down is that they think they can get back to even faster. For example, they buy a stock for $1, and it falls to 70 cents. A lot of people will say, “Well, if I double up at 70 cents and the stock has a bounce, I’ll get back to even quicker and then I can sell and I can get out at evens.” That’s not even a long-term investment strategy. That’s just a strategy to try to breakeven. And it’s a bad strategy at that, because often it’s a case of throwing good money after bad.

Ask yourself this: say you average down and the shares don’t bounce back. Say they halve in value. What do you do? Do you buy more? And then they half again. Do you keep buying? And this is what a lot of people do. They’ll average down all the way to zero in some cases. It can be a complete disaster. This is why I say averaging down is such a dangerous strategy.

In fact, averaging down can be a wealth destroyer.

So that’s rule number two. Don’t average down unless you really know what you’re doing. Make sure you have an exit strategy and that you know you’re wrong. But for most people, averaging down is a strategy which is best left alone.

Let’s jump to the next rule for surviving a bear market.

#3 Have an exit strategy

This is such an important rule. Know where you’re getting out. Know where you’re wrong. Everyone who buys a stock should know their maximum pain point. While we don’t know what the market is going to do next, if we have a good exit strategy, we know what we are going to do. We know whether we’re going to hold or whether we’re going to sell. That’s all tied up in your exit strategy.

An exit strategy is like an escape hatch. It gets you off the playing field when the game starts going against you. And this works in terms of both profitable trades and losing trades.

I’m going to give you an example. This is another real-life example from my own portfolio. It’s also a trade from my Motion Trader subscription service. You see, I follow many of the trades myself.

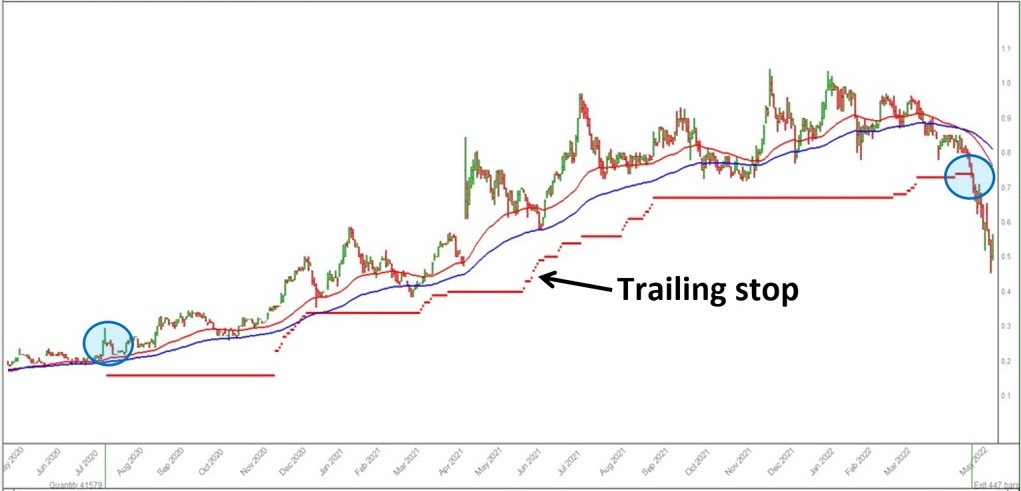

Here’s the chart:

I bought shares in a company called Universal Biosensors [ASX:UBI] in July 2020 (first blue circle).

Now, have a look at the red line below the share price. It looks a bit like a rising staircase. That’s my trailing stop. My exit strategy is to use a trailing stop to determine when to sell. You can read more about trailing stop strategies here.

Trailing stops aren’t the only exit strategy. There are other ways which also work. The point is that you have an exit strategy. For many people, selling is merely an afterthought.

But for me, the trailing stop is an excellent way to know went to sell shares. My trailing stops are a calculated exit level which are determined by a stock’s volatility and percentages. It’s not discretionary. It’s calculated. The trailing stop tracks beneath the share price.

Notice how the trailing stop gives the stock lots of room to move. This is because pullbacks and consolidations are a normal part of how a market operates. You’ve got to give a stock room to move if you’re to stay in a big medium-term trend. Big trends often have pullbacks of 15 to 25%, maybe more. You’ve got to give them room to move to stay on them.

But at some point, the trend is going to bend far enough that it comes back and hits the trailing stop. The trailing stop is like a line on the stand. It gets you out when the trend appears to be changing. And that was the case with my trade in UBI. It had been a great trade, but the share price had come back to the trailing stop, and I sold (second blue). I was able to lock in a gain of 180%.

But many people don’t know when to sell their shares. They’ll let their profits run and get an excellent outcome from that perspective. But then they don’t know when to sell a stock, and they don’t know when conditions change. In many cases, they end up riding a great trend all the way back down to where they got in. I’ve seen it happen many times. But that’s completely avoidable if you have a good exit strategy.

UBI continued falling after my exit. A strong exit strategy has made a big difference to my result.

That’s rule number three, have an exit strategy that tells you when to sell your shares.

Let’s move to the final rule.

#4 Keep perspective and be patient

This rule is so important. Yes, bear markets are difficult. But they do pass, and good times return.

Have a look at this:

This is a monthly chart of the Dow Jones Industrial Average going back to 1897. That’s over 120 years of data. It includes dozens of cycles and many bull and bear periods. Yes, the bearish phases are tough. Yes, they’re frustrating. But it’s how the market works. It’s important we recognize this.

Just looking at the huge advance over the century. It’s so easy to see the big sweeping rallies and not pay too much attention to the pullbacks along the way. But it turns out that, on average, we get a 10% correction about once a year. We get a 15% correction about once every 2 years, and then once every 3.5 years, on average, we get a correction of around 20% or more.

The COVID crash and recovery, gave a lot of new investors the wrong impression of a bear market. The market crashed almost 35% in 6 weeks. It then had a record-breaking recovery which took the market to new all-time highs.

But that’s not how a bear market typically works. Bear markets are often volatile. And they can grind on for 6 to 12 months, sometimes even longer. The closest experience I can think of to the COVID sell-off was the 1987 stock market crash (see blue square). The S&P 500 fell rapidly and then recovered to new all-time highs within a year.

After making a new high in 1988, the S&P 500 experienced a 25% correction. It felt like a big deal at the time and caused investors considerable angst. But it only appears as a blip on the chart. After a pause in the trend, the market resumed its centuries long climb up the “wall of worry”.

Just remember, bear markets are a normal part of the market cycle. While stressful and unsettling, they do pass. The key is to have strategies to minimise risk and help you exit stocks that aren’t performing. It’s all about coming out the other side with most of your capital intact.

Good strategies can also make a big difference emotionally. Maintaining the right mindset can keep you in the game when others quit. And if you can do that, then you’ll be ready for the new buy signals when they’ll inevitably come.

What to know strategies the pros use to buy and sell shares?

Learn how to identify some of the best stocks to buy now in this free video training. You’ll learn a complete stock trading strategy for buying and selling shares with confidence. I’ll also share real life examples to help you apply the knowledge and build a profitable share portfolio.

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisor firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).