When You Should Break Your Trading Rules: Lessons from a Top Trader

By Jason McIntosh | Published 3 May 2023

One of the biggest rules for successful trading is to never break your trading rules. Following your trading rules for buying and selling shares is the hallmark of a successful trader. People who lack this discipline typically end up with little money in their accounts.

But do top traders ever break their rules?

Let’s start with a story from early in my career. It’s about one of the world’s greatest traders who was my role model when I was starting out in the markets. His name is Ed Seykota, and he’s one of the pioneers of algorithmic trend-following trading.

I first read about Ed in Jack Schwager’s bestselling book, Market Wizards. It was 1993 and I was a junior trader on the Foreign Exchange desk at a leading investment bank. While I’ve never met Ed, I refer to him as one of my mentors who I know through print.

Ed said there are five key trading rules:

- Let your profits run

- Cut your losses early

- Have many relatively small trades

- Stick to your rules no matter what

And, possibly the most important (and controversial)…

5. Know when to break the rules

Now, rule number five contradicts four. It seems like an odd, and possibly silly addition to the preceding career making rules.

But knowing when to break the rules is actually very important.

Don’t get me wrong. Breaking your trading rules isn’t a good habit to get into. But occasionally, situations can arise that warrant some flexibility to time-tested and robust set of trading rules.

I’ll tell you about an example from my own portfolio.

My trading approach is called trend following. It’s an elegantly simple process that just about anyone could use. There’s no rocket science. Just a straightforward repeatable process.

I essentially use moving averages and breakouts to identify opportunities. I then use risk management strategies to maximise profits and keep losses relatively small…. much like Ed’s first four rules.

And when you pair a trend following strategy with a relatively wide trailing stop, it’s possible to get some very large triple digit gains.

So, onto this this example….

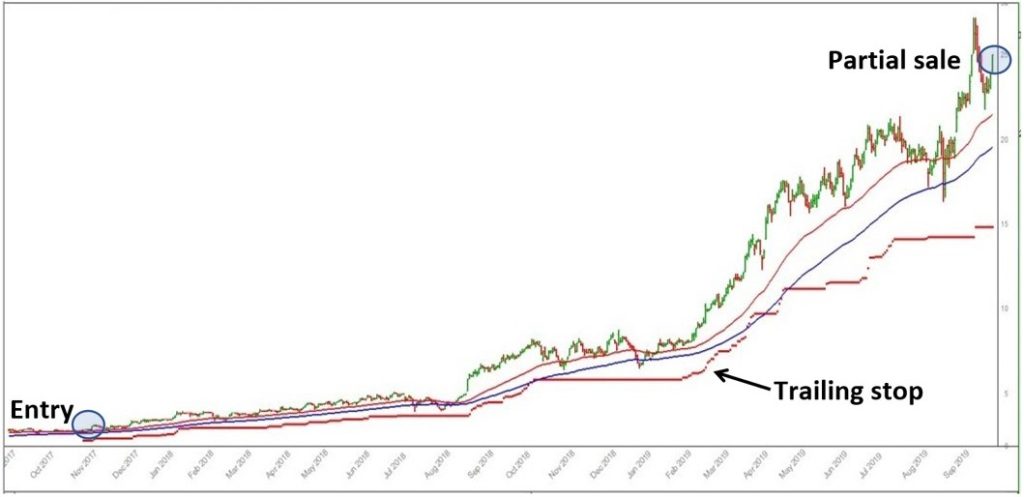

I bought a stock called Jumbo Interactive [ASX:JIN] in October 2017. The buy signal was due to a positive set-up in the moving averages and the shares hit a new 70-day high. There was nothing extra special about the signal. It was like many others.

Ed’s third rule is to have many relatively small trades. And that’s exactly what I do. This spreads risk and increases the odds of getting on several big trends. At the time, I was investing 2.5% of capital in each stock (I’ve since changed this to 1.25% to allow easier movement in and out of less liquid companies).

Now, here’s the thing….

Jumbo started to rally. First through 50%, then 100%, then 200%….

And like any good trend follower, I didn’t exit. I let the profit run.

Jumbo ultimately rose by 893% from my entry point.

Have a look at this chart:

Remember rule number one?

Letting your winners run is so important. It’s a critical part of the process. That’s because trend followers make most of their money from a relatively small number of big trends. These trends could rise by large double or triple digit figures.

And these big trends don’t come along every day. So when you do appear, it’s a case of staying on the trend for as long as possible and making as much money as possible.

But this led to a new problem.

Jumbo went from 2.5% weighting in my portfolio to close to 15% of my portfolio. It was now a large position, which significantly increased risk.

What would you do in this situation?

Do you sell or keep holding?

I grappled with this for a while. I didn’t want to break my trading rules. The reason I had such a large profit was because I’d resisted the temptation to sell.

But with Jumbo being such a weighty position in the portfolio, I decided to sell a third of my holding. This reduced my risk while still staying with the position.

Jumbo gradually fell back to its trailing stop over the next four months. This was the trigger to sell the rest of my holding. I ended up with an overall profit of more than 500%.

More often than not, I’ll stick to my trading rules. Consistency and discipline are a core trait of just about every successful trader. People who frequently break their trading rules are rarely successful.

But there will always be exceptional situations that may require a tweak to the plan. Knowing when to occasionally break the rules can be a value adding skill.

If you’d like to know more the trading rules I use and how to apply them to trend following strategies, then I have a series of videos and articles that could help.

You can get all the details here

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisor firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).