A Classic Value Play in Bisalloy Steel (ASX:BIS)

By Jason McIntosh | Published 10 September 2021

Jason McIntosh explains why Bisalloy Steel [ASX:BIS] could be an ASX stock to buy now. The company has the hallmarks of a classic value play, with growth prospects to boot.

Many of the stocks I profile standout for their growth potential. Companies like Atomos [AMS], Readytech [RDY], and Novonix [NVX] are recent examples.

But a high growth story isn’t everything.

Momentum can help identify all sorts of opportunities. These range from big stocks to stocks that few people know. They also include growth stories and value plays.

Bisalloy fits the two latter categories. It’s a small cap company with an impressive value story. And what draws my attention is a gathering momentum profile.

If you aren’t familiar Bisalloy, you’re not alone. With a market cap of only $70 million, it typically doesn’t capture the headlines. It’s also outside the All Ordinaries.

So, what does the company do?

Bisalloy is Australia’s only manufacturer of high-strength structural steel. Its uses include armour and wear resistant applications in mining, construction, energy, and defence.

A point of interest: Bisalloy’s armour plates were used in Australia’s submarine fleet.

The company exports to Asia, Europe, the Middle East, North America, and South America. It also has a distribution network in Indonesia, Thailand, China, and the UAE.

Let’s have a look at the fundamentals…

The company recently released its 2021/21 full year result. Operating EBITDA (earnings before interest, tax, depreciation, and amortisation) was up 25.4% to $16.7 million.

Net Profit After Tax came in at $9 million — a rise of 31.1%.

Shareholders saw the benefit of the strong result. The dividend rose to 9 cents per share, putting the stock on a fully franked yield of 6.25% (at a share price of $1.44).

It’s interesting to look back over the past few years. Just like when I look at a share price graph, I want to see positive trends in a company’s financials.

And that’s the case is Bisalloy.

EBITDA is up each year since 2016. It’s also had double digit return on equity since 2018. I believe this is the mark of a well run company.

Management forecast profitability increasing for 2021/22 (subject to COVID). And given their history of increasing EBITDA every year since 2016, this sounds achievable.

Bisalloy has the hallmarks of a classic value play. It has a low valuation (price/earnings ratio around 8 times), and a dividend north of 6%. Good growth prospects add to the appeal.

The trend is also positive — a key criteria for my approach.

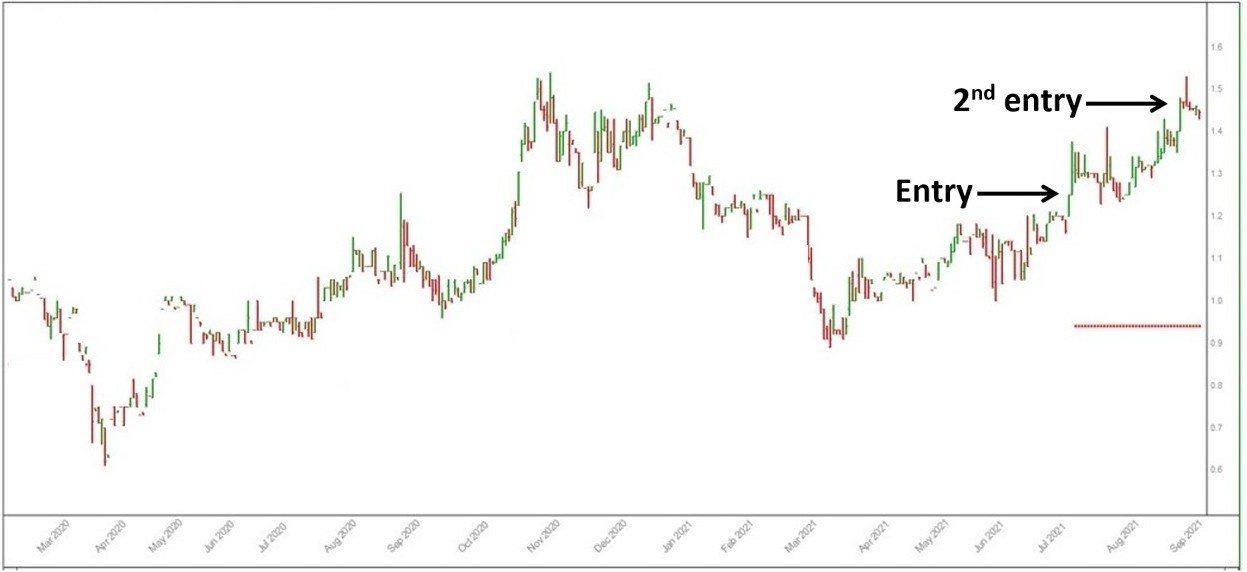

Let’s have a look at the chart:

Bisalloy first appeared in my daily scans in July. It was regaining upward momentum after a multi-month pullback, and this was the trigger for a buy signal.

A second entry occurred in August due to the trend extending higher.

One cautionary point is the company’s relatively low trading volume. This means it can require patience to buy and sell. And it could be difficult to sell in a fast decline.

But I believe the risk is manageable. Motion Trader’s strategy involves many relatively small trades (not a few big ones). This helps minimise the risk with any single stock.

It’s possible the stock will need time to consolidate after the recent rally. But the big picture trend is positive. I believe Bisalloy has solid upside potential from current levels.

Where to invest now?

Looking for ASX stocks to buy now, as well as off the radar ideas most people don’t know? Our algorithms scan the stock market daily for medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

If you’re ready to get started, try a no obligation 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.