Finding the Unfindable: Family Zone Cyber Safety (ASX:FZO)

By Jason McIntosh | Published 10 September 2021

Jason McIntosh explains why Family Zone Cyber Safety [ASX:FZO] could be an ASX stock to buy now. The company is an emerging tech player that keeps kids safe online. It’s achieving record growth but is off the radar for many investors.

Scanning the ASX for momentum is one of my jobs. It’s fascinating to see some of the names that come up in the scans — many are stocks I’d never heard of before.

This week’s signal in profile is a case in point…

FZO has a market cap of about $530 million. It’s not yet in the All Ordinaries, so it doesn’t get much analyst coverage. This makes it practically unfindable for many people.

But that needn’t be the case.

You see, a rising share price can help you identify stocks like FZO. It draws your attention to situations others miss. You could say that momentum is opportunity’s calling card.

So, what does Family Zone Cyber Safety do?

FZO is a technology company that keeps kids safe while online.

Its software connects to the family’s network of devices and is managed from a parent’s smart phone. Some of its uses include managing screen time, blocking adult content, restricting social media, and limiting app purchases.

The company’s presence isn’t limited to the home. It also works with schools to provide cyber solutions and promote better classroom management. Over 18,000 schools around the world use FZO’s software, forming a key part of their strategy.

And demand is growing quickly…

The company generated record growth in the June quarter. Annual Recurring Revenue rose 95% year-on-year to $15.3 million. There was also 164% jump in student licences to 2.4 million. Schools under licence were also up, rising 127% to around 4,100.

A key growth area is the US market. FZO added over 1 million students and 2,000 schools in the June quarter. This equates to over 5% of all US schools (up from 2% a year ago). The company expects continuing record growth due to unprecedented school funding.

FZO is also growing through acquisition.

The first of two recent purchases is NetRef — a US based classroom technology business. The acquisition (for around $5.8 million) gives FZO access to an innovative product plus technical and sales expertise.

But the most significant deal is the $142 million purchase of Smoothwall — the UK’s leading provider K-12 digital safety. Smoothwall has around 38% of the UK education market, and annual recurring revenue of around $30 million. It services more than 12,400 schools and 6 million students.

Management is upbeat about overlaying Smoothwall’s AI based monitoring tools with their existing product. Managing director, Tim Levy, describes the prospect as a “showstopper”. He says that bringing the two products together will add value to both businesses.

And just so you know, the company isn’t profitable yet. This is very much a growth story with a lot of potential. But ultimately, they need to turn growth into profits.

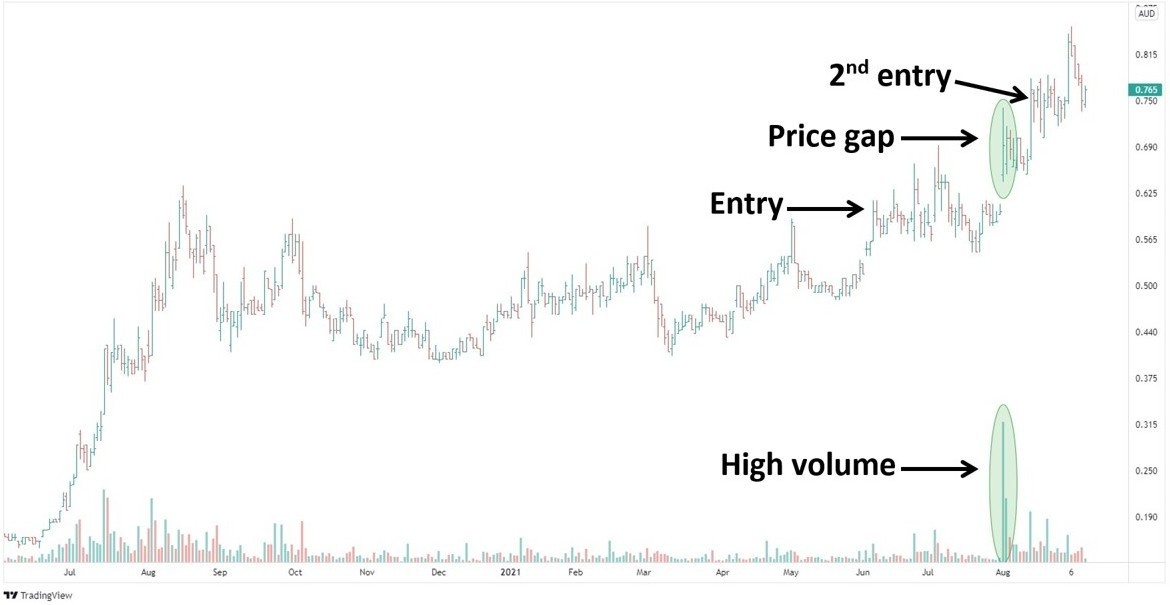

Okay, let’s have a look at the chart:

FZO had a strong rally during mid-2020. The shares reached a peak in August and then settled into a 10-month trading range. You’ll see the range on the chart.

Trading ranges are periods of choppy back-and-forth price action. The lack of consistent momentum makes them tricky to trade. I believe the best strategy is to simply avoid them.

But they often lead to excellent opportunities…

You see, a breakout from a range signals a potential new trend. Positive news often accompanies an upward break — the opposite usually occurs when prices break lower.

FZO broke to the topside of the range in June (triggering Motion Trader’s initial entry). It then traded sideways for several weeks before accelerating higher last month.

Motion Trader gave a second buy signal in August.

There’s one more chart I want to show you:

This is the same chart as before.

But this time I’m highlighting a different pattern — a “buyable gap-up”.

Many people steer clear of stocks that gap higher. Their first thoughts are that it’s too late to buy, and they worry that the price will quickly fall back.

But this often isn’t the case. In fact, a big price surge can be an opportunity.

Rather than being a sign that an advance is almost done, a gap higher often results in an extension of the uptrend. It’s a case of strength leading to more strength.

The key to the pattern is high volume. A valid signal requires the gap higher be accompanied with an increase in volume of at least a 150% (on recent trading volume).

Have a look at FZO’s volume on the day prices gapped higher. You’ll notice a big surge in turnover. This is a sign that a lot of money is after a seat at the table.

Buyable gap-ups don’t guarantee that a stock will continue higher. As with any entry set-up, many signals will inevitably fail. That’s why we use strategies to manage risk.

It’s possible the stock will need time to consolidate after the recent rally. But the big picture trend is positive, and I believe the stock has plenty of upside potential.

And finally, management have large personal stakes in the company. I always like to see that the people running a business are backing it with their own funds.

Where to invest now?

Looking for ASX stocks to buy now, as well as off the radar ideas most people don’t know? Our algorithms scan the market daily for medium term investment trends. We then tell our members precisely when to buy. And most importantly, we tell them when to sell.

If you’re ready to get started, try a no obligation 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.