How to Find ASX Stocks in a Strong Uptrend

By Jason McIntosh | Updated 28 October 2025

If you’ve ever looked back at a stock chart and thought, “I wish I’d bought that months ago,” you’re not alone. The biggest gains in the share market often come from ASX stocks in a strong uptrend — shares that keep climbing higher, while others struggle.

But spotting those uptrends in real time isn’t always easy. Many investors jump in too early, only to get stuck in a sideways market. Others wait too long, buying just as the trend is running out of steam.

So, how do you find ASX stocks that are genuinely in a strong uptrend? The answer isn’t guesswork, tips, or hype — it’s a systematic approach. By applying a set of clear rules, you can potentially identify the best opportunities and avoid the traps.

In this article, I’ll look at how professional traders define an uptrend, the key indicators to watch, and how a rules-based method can help you identify ASX stocks with real momentum.

What Is an Uptrend in the Share Market?

An uptrend is one of the most important concepts in technical analysis. At its simplest, an uptrend is when a stock makes a series of higher highs and higher lows. Each rally pushes the price to a new peak, and each pullback finds support above the previous low.

Think of it as a staircase moving upward. Step by step, the price climbs higher, even if there are pauses or moderate declines along the way.

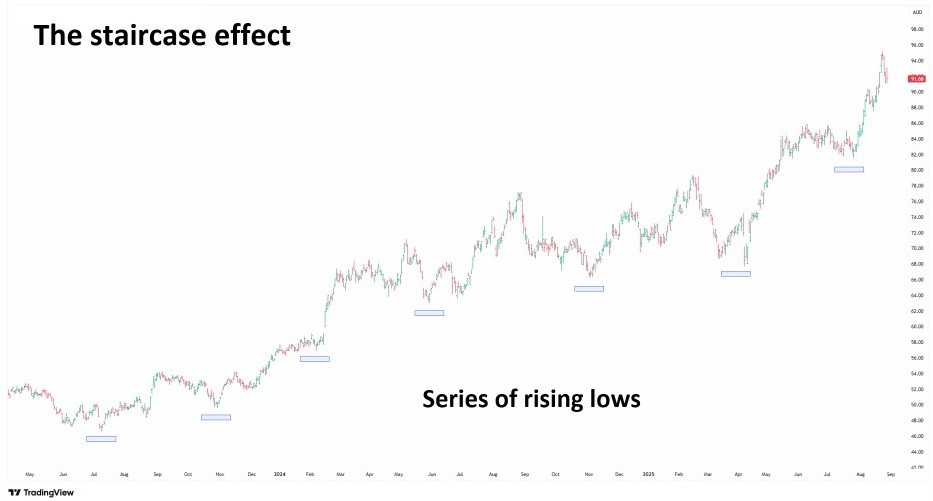

📊 Example: Wesfarmers (ASX:WES)

The chart above shows Wesfarmers making a series of rising lows. Each dip finds support higher than the last, creating a staircase effect that signals strength.

It’s also important to understand that trends exist across all timeframes:

- A short-term trader might use a one-minute chart to capture intraday trends.

- A long-term investor could look for uptrends on weekly or even monthly charts.

For many ASX investors, a practical timeframe is using daily charts to identify trends with the potential to run for one to three years. This horizon allows for substantial, sometimes triple-digit gains, but not so short-term that you need to constantly buy and sell.

Why ASX Stocks in a Strong Uptrend Matter for Investors

The biggest winners on the ASX nearly always come from stocks in strong, sustained uptrends. These are the companies that continue to climb and often outperform the broader market. Identifying these stocks relatively early — and then riding the trend — can lead to the type of gains that transform a portfolio.

An uptrend reflects demand. More investors are willing to pay higher prices, often in response to earnings or sector themes. Whatever the driver, price action itself is proof that money is flowing into the stock.

Consider the alternatives. Sideways stocks tie up capital, and downtrends destroy it. By focusing on shares already moving higher, help you stack the odds in your favour.

For trend followers, the key insight is this: the path of least resistance is up. Rather than trying to predict turning points, a systematic trend following strategy identifies and rides both emerging and established uptrends for as long as possible.

This approach can feel counterintuitive at first. Many investors cling to the old saying “buy low, sell high.” The problem is that people often interpret this as buying stocks that are falling, hoping they’ll bounce. That mindset can lead to painful losses. A better way to think about it is: buy high, sell higher. That’s how many professional trend traders capture some of their biggest gains.

How to Identify a Strong Uptrend

Spotting a genuine uptrend means looking for structural signs of strength.

Moving Averages: The #1 Indicator for Many Professionals

One of the simplest and most effective ways to identify an uptrend is with moving averages. Many professional investors rank them as their most reliable indicator. By smoothing daily fluctuations, moving averages reveal the underlying direction of a stock.

For medium-term investing, the 50-day and 100-day averages are especially effective. Strong trends are often marked by:

- The 50-day above the 100-day.

- Both averages sloping upwards.

- The share price consistently trading above them.

This classic structure of an uptrend indicates that demand is strong enough to potentially keep pushing prices higher.

Breakouts: Extra Confirmation of an Uptrend

While moving averages provide a primary signal, breakouts add tactical confirmation. Stocks often oscillate either side of their averages. Buying too early — at the first upward cross — can see the stock dip back below the average.

A breakout strategy waits for the share price to push through a pre-determined high (for example, a 20-day or 70-day high). This provides extra confirmation that momentum is strong enough to support a continued advance.

Breakouts can also identify opportunities within established trends. After a strong run, a stock often pauses to consolidate, drifting sideways toward its moving averages. A buy signal occurs when the share price breaks to a new high, marking the resumption of the trend.

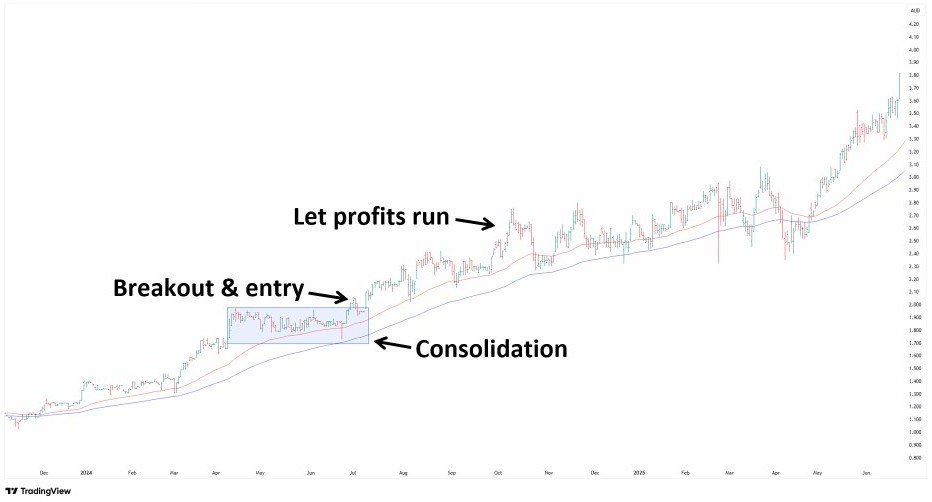

📊 Example: GenusPlus (ASX:GNP)

The chart shows how GNP consolidated sideways before breaking out to a new high, confirming the uptrend. You’ll also notice the rising moving averages.

Breakouts help provide an edge over relying on news or fundamentals. Price action shows where professional money is flowing — and trend analysis puts you in sync.

Many professional investors use breakouts and moving average strategies to discover undervalued ASX stocks. While these stocks may not make the headlines, breakouts and moving averages help detect their share price movement long before many people are of the opportunity.

Market Structure & Volatility

A healthy uptrend also has:

- A series of rising lows.

- Prices holding above rising averages.

At the same time, not every breakout is worth following. A systematic process can filter out those with excessive volatility, which often signals unstable conditions. By focusing on orderly, well-structured trends, you can increase the probability of success.

Stacking the Deck

No one knows in advance which uptrends will turn into the next big winners. A trend following approach tilts the odds in your favour by consistently selecting stocks with the right characteristics, then applying risk management to stay with the strongest performers. From there, a robust risk management strategy ensures you exit weaker trades while staying with those that continue to run.

This is the essence of trend following: keep losses small, and let winners run long enough to potentially deliver outsized gains.

Managing Risk Within an Uptrend

Finding uptrends is only half the job. The other half is knowing how to manage them once you buy.

Professional trend followers always pair their entry strategy with an exit strategy. The goal isn’t just to capture gains — it’s also to protect capital when a trade doesn’t work out.

One of the most effective tools is the trailing stop, which raises the exit level as a stock moves higher. This locks in gains while leaving room for the trend to continue. Some systems also use time-based rules to exit stocks that fail to rise within a set period after entry.

I’ll cover trailing stops in detail in a separate guide. For now, remember this: finding uptrends puts you on the right side of the market, but trailing stops help you stay there long enough to benefit — while limiting damage when a trend fails.

Common Mistakes Investors Make With Uptrends

Even with a strong stock, emotion and timing errors can ruin results. Common mistakes include:

- Buying too early — entering before confirmation, or mistaking a rebound in a downtrend for the start of a new trend.

- Chasing at the peak — rushing in after a sharp run-up, just before a pullback.

- Selling too soon — the biggest mistake of all — cashing in small gains while missing the bigger move. This is the #1 reason many investors underperform.

- Holding on too long — riding a winning trade all the way back down without a stop-loss. A selling strategy isn’t just about cutting losers — it’s about protecting large profits.

- Ignoring volatility — chasing unstable, erratic breakouts.

The thread running through these mistakes is emotion — fear, greed, or hope. A rules-based process helps replace emotion with control.

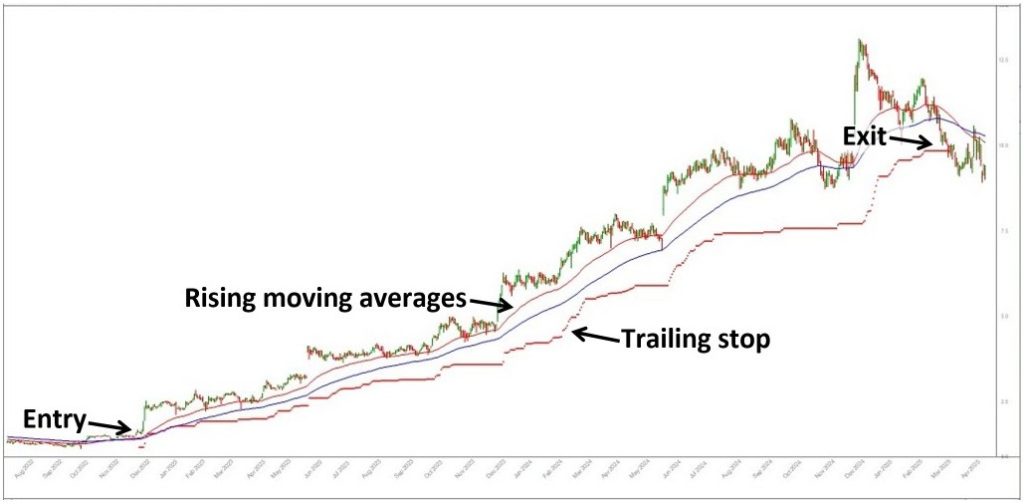

Case Study: Gentrack (ASX:GTK)

Gentrack provides a clear example of these principles in action.

After a long sideways period, it began to show early signs of strength:

- The 50-day crossed above the 100-day, and both turned higher.

- Rising lows confirmed demand.

- A breakout to a new high triggered a buy signal.

📊 Example: Gentrack (ASX:GTK)

From there, the shares gained momentum and went on to deliver a 515% gain in just over two years. I also held it in my own portfolio.

Notably, Gentrack wasn’t a household name. That’s one of the strengths of trend analysis — it can uncover profitable opportunities that others overlook. Momentum and trend act like ripples in the water — drawing your attention to stocks with the potential to deliver outsized gains.

Of course, not every breakout becomes a winner. Risk management ensures that weaker trades are cut quickly, while strong trends are held for as long as they continue.

How to Apply This in Your Portfolio

Here’s a practical way to put trend following into action:

- Screen for candidates: stocks with rising averages, breakouts, and healthy structure.

- Apply filters: avoid erratic, volatile moves.

- Manage risk: use trailing stops or time rules to protect capital.

- Stay disciplined: follow the rules, not tips or headlines.

This isn’t about predicting the next big winner. It’s about stacking the deck by consistently applying proven criteria. A handful of strong performers can make all the difference.

That’s what Motion Trader is built to do: systematically uncover opportunities across the ASX, then manage them with clear exit strategies. By taking the emotion out of the process, you can gain clarity, confidence, and consistency in your investing.

Conclusion

The biggest gains in the market come from ASX stocks in a strong uptrend. By learning to recognise the signs — rising moving averages, breakouts, and constructive structure — you put yourself in a position to capture those powerful moves.

The challenge is that not every breakout becomes a major winner. That’s why a rules-based approach is so valuable. It doesn’t rely on tips or guesswork. Instead, it applies consistent criteria to identify opportunities, while using risk management to protect capital when trades don’t work out.

Trend following isn’t about predicting the future. It’s about aligning yourself with the strongest currents in the market, and then letting those trends reveal their full potential. Just a handful of stocks like Gentrack can make a dramatic difference to long-term performance.

If you’d like to see how a systematic process can help you uncover and manage opportunities like these across the ASX, Motion Trader offers resources, case studies, and trial access to the full service. It could be the first step toward making trends work for you.

Frequently Asked Questions

How can I tell if an ASX stock is in a strong uptrend?

Look for rising 50- and 100-day moving averages with price above both. This structure signals that buyers are consistently in control.

What indicators help confirm an uptrend?

Trend-followers often use moving averages, trendlines, and relative strength to confirm that the stock is making higher highs and higher lows.

When is the best time to buy into an uptrend?

Many traders add on strength after brief pullbacks to support, ensuring they enter when the trend resumes rather than chasing extended rallies.

Put These Strategies Into Action

Motion Trader’s algorithms scan more than 2,000 ASX stocks every day to uncover medium-term trends. Members receive precise buy signals — and just as importantly, clear instructions on when to sell.

If you’d like to see how a rules-based process could help you apply the principles from this article, you can try Motion Trader with a no-obligation FREE 14-day trial.

👉 Start your free 14-day trial here

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).