ASX Breakout Trading Strategy: How to Use Moving Averages to Enter Strong Trends

By Jason McIntosh | Updated 28 October 2025

Introduction

ASX breakout trading strategy is about buying strength, not weakness — and that’s what makes it so powerful. For investors, the biggest challenge isn’t just spotting strong trends, it’s knowing when to enter. Get in too early and a stock may drift sideways or fall. Get in too late and much of the move may already be gone.

That’s where a breakout strategy helps. Breakouts give traders a systematic way to buy when momentum is strong, without relying on tips or guesswork. And when combined with moving averages, breakouts become a powerful tool for entering genuine uptrends on the ASX.

In this article, we’ll look at how breakouts work, why combining them with moving averages makes such a difference, and how you can use this approach to stack the odds in your favour.

What Is a Breakout?

A breakout occurs when a stock pushes through a clearly defined resistance level, such as a recent high. Instead of buying while prices are stuck in a range, breakout traders wait for confirmation that momentum is strong enough to carry the stock higher.

This is where an ASX breakout trading strategy differs from the old saying “buy low, sell high.” Breakouts are about buying strength, not weakness. The logic is simple: if a stock is making new highs, it means demand is overwhelming supply — and that’s a key sign of an emerging uptrend.

Breakouts can follow short consolidations or longer sideways trading ranges. The important part is that the share price moves beyond a barrier that previously held it back. While not every breakout turns into a major trend, consistently applying a breakout strategy in the right conditions can uncover some of the market’s biggest winners.

Why Combine Breakouts with Moving Averages?

On their own, breakouts can be unreliable. A stock may surge to a new high on news or speculation, only to quickly reverse. That’s why many systematic traders prefer not to use breakouts in isolation.

A more robust approach is to combine breakouts with moving averages. Moving averages smooth out day-to-day noise and reveal the underlying direction of a trend. When the 50-day average is above the 100-day average — and both are rising — it suggests momentum is to the upside.

This filter can make an important difference. Consider the charts below:

📊 Chart: Woodside (ASX:WDS)

- WDS shows falling 50- and 100-day moving averages.

- In this environment, breakouts are typically ignored — the bigger trend is down, and rallies are less likely to continue.

📊 Chart: Commonwealth Bank (ASX:CBA)

- CBA shows rising 50- and 100-day moving averages.

- In this environment, breakouts are often more effective — demand is stronger, and price is aligned with the trend.

By focusing on breakouts when moving averages confirm an uptrend, you help tilt the probabilities in your favour. It’s about trading with the tide, rather than against it.

Breakouts and moving average strategies are also an excellent screening tool to discover undervalued ASX stocks. While these stocks often won’t make the headlines, breakouts and moving averages can detect their share price movement long before many investors become aware of the opportunity.

Types of Breakouts Used in a Trading Strategy

Not all breakouts are the same. Some are short-term moves that can quickly fail, while others signal the continuation of a much stronger trend. Systematic traders often use different breakout lengths to balance responsiveness with reliability.

Shorter-term breakouts (around 20 days):

- Can capture emerging moves earlier.

- May get you into a trend sooner, but have a higher chance of false signals.

- Useful for investors who want more frequent opportunities, while accepting that many trades may not follow through.

Longer-term breakouts (such as 70 days):

- Provide stronger confirmation that momentum is in place.

- Less frequent signals, but they can reduce the risk of being caught in a false move.

- Favoured by many trend followers for identifying sustained opportunities.

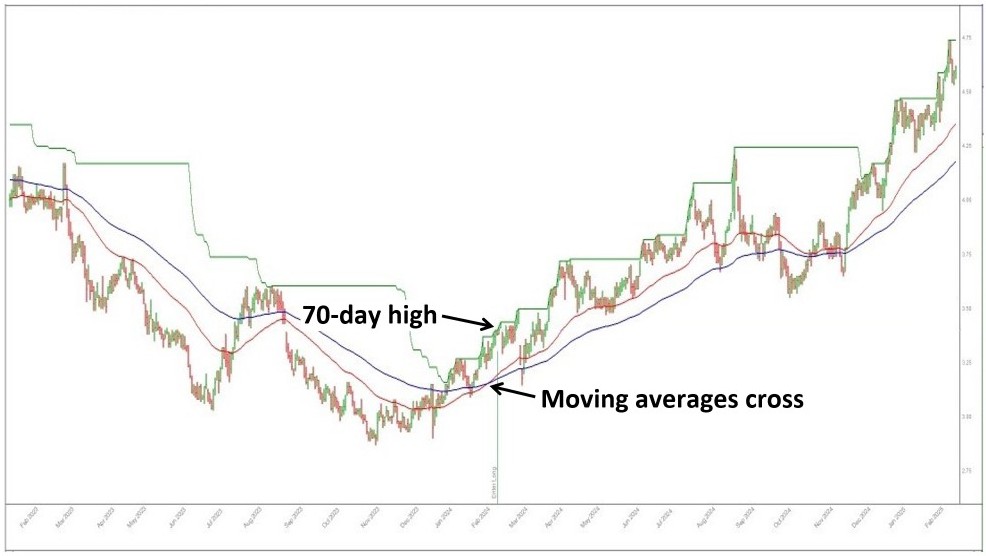

📊 Chart: MyState (ASX:MYS)

- The chart below shows a 70-day high (green line).

- When the share price breaks above this level, it indicates the stock is at its strongest point in more than three months.

- This can be a useful confirmation that the trend is up and that further gains are possible.

While no one knows in advance which breakout will lead to a major trend, breakouts can help identify entry points where momentum is in the investor’s favour.

Filtering Out False Breakouts

One of the biggest challenges with breakout trading is that not every move to a new high results in a lasting uptrend. Some breakouts quickly reverse, leaving investors caught on the wrong side of the trade.

This is where filters come in. Rather than chasing every new high, a systematic process applies rules to help identify which breakouts are worth following.

Volatility filter:

- Breakouts that occur with erratic, wide price swings can be unstable.

- Filtering for smoother, more orderly price action helps avoid many of the “spikes” that fail.

- This doesn’t guarantee success, but it can improve the overall probability of staying with the strongest trends.

Market structure filter:

- A healthy breakout usually happens when the share price is already trading above rising moving averages.

- Stocks making a series of higher lows (each dip bottoms above the last) are generally in stronger condition.

- Breakouts that occur within this structure often have a better chance of developing into sustained moves.

By focusing on orderly breakouts within established uptrends, you can help tilt the odds in your favour. It’s not about predicting which trade will be a winner, but about consistently choosing situations where momentum is already supportive.

Common Mistakes with Breakouts

Breakouts can be a useful way to enter strong trends, but many investors struggle to apply them consistently. Emotions such as fear of missing out, or reluctance to sell, often get in the way. Here are some of the most common pitfalls:

- Buying breakouts without context

- Jumping into a stock just because it hits a new high, without checking if the moving averages are rising.

- Breakouts that occur in downtrends are more likely to fail.

- Chasing high-volatility spikes

- Some breakouts occur on sudden, erratic moves.

- These can quickly reverse, leaving investors caught at poor prices.

- Selling too soon after a breakout

- Locking in a small gain can feel safe, but it often means missing the larger move.

- A systematic approach aims to stay with a trade for as long as the uptrend remains intact.

- Holding through a failed breakout

- Not every breakout leads to further gains.

- Without a stop-loss, investors can watch a small loss turn into a large one.

Breakout strategies are not about perfection — some trades will work, others won’t. The goal is to avoid the common traps and focus on applying a consistent process. Over time, it’s this discipline that helps identify and stay with the strongest opportunities. A core aim of breakout trading is to make large profits when right, and to keep losses relatively small when a breakout fails.

Case Study: Catapult (ASX:CAT)

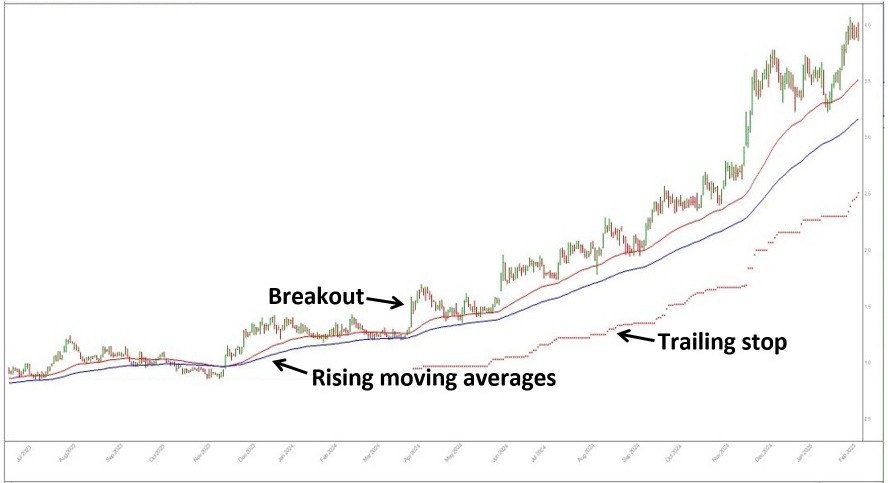

Theory is one thing, but seeing how a breakout works in practice makes the lessons far clearer. Catapult (ASX:CAT) provides a good example of how moving averages and breakouts can combine to identify a strong trend.

For around four months, CAT traded sideways while remaining above its rising 50- and 100-day moving averages. This meant the stock was already in a bullish structure, but no buy signal was triggered during the consolidation.

The breakout came when the share price pushed to a new high near the middle of the chart. This move confirmed that demand was strong enough to overcome resistance. With moving averages already trending higher, the breakout provided a tactical entry point.

From there, the trend ran for over a year. Investors who applied a systematic breakout strategy had the potential to capture large gains while keeping risk controlled with a stop-loss.

📊 Chart: Catapult (ASX:CAT)

- Shows a period of sideways consolidation above rising moving averages.

- Breakout to a new high triggered an entry signal.

- Trend continued for more than a year, creating the potential for significant profits.

This case study highlights an important point: not every breakout will lead to a major trend, but by focusing on those that occur in stocks with rising moving averages, you can tilt the odds in your favour.

How to Apply a Breakout Strategy in Your Portfolio

Applying a breakout strategy doesn’t mean chasing every stock that hits a new high. The aim is to follow a set of rules that help identify situations where momentum is in your favour and where risk is controlled.

1. Screen for candidates

- Focus on stocks trading above rising 50- and 100-day moving averages.

- This helps filter out breakouts that occur in downtrends or sideways markets.

2. Look for valid breakouts

- A breakout to a 20- or 70-day high (or a variable that suits your approach) can provide a tactical entry point.

- Shorter breakouts may act faster, while longer breakouts can offer more confirmation.

3. Apply volatility filters

- Avoid breakouts that occur on erratic or disorderly price action.

- Well-structured trends are generally more reliable.

4. Manage the exit

- Not every breakout will continue.

- A stop-loss provides protection when a breakout fails.

- The aim is to let strong trends run while keeping losses relatively small.

By following a consistent process, you avoid relying on predictions or emotions. The key isn’t trying to guess which breakout will become a big winner — it’s systematically building a portfolio of opportunities and letting the market reveal which ones go the distance.

Conclusion: Breakouts as Part of a Disciplined Strategy

A breakout strategy can be a valuable tool for entering strong trends on the ASX. By itself, a breakout may or may not lead to further gains. But when combined with rising moving averages, volatility filters, and sound risk management, breakouts can help identify entry points where momentum is in the investor’s favour.

The key is discipline. Not every breakout will work, and some trades will end in losses. But a systematic approach aims to keep those losses contained, while allowing winning trades the room to run. Over time, this balance is what makes trend following effective.

If you’d like to see how a systematic process can help you uncover and manage opportunities like these across the ASX, Motion Trader offers resources, case studies, and trial access to the full service. It could be the first step toward making trends work for you.

Frequently Asked Questions

What is a breakout strategy in ASX trading?

A breakout strategy looks for stocks that move above a key resistance level on increased volume. This signal can mark the start of a strong trend.

Are breakout strategies profitable?

Yes (although not always), when combined with sound risk management. Using wide trailing stops and trading only in rising markets helps improves success rates.

How do I find breakout stocks?

Use price filters to identify stocks hitting multi-week highs above rising moving averages. Combine this with a rules-based entry for consistency.

Put These Strategies Into Action

Motion Trader’s algorithms scan more than 2,000 ASX stocks every day to uncover medium-term trends. Members receive precise buy signals — and just as importantly, clear instructions on when to sell.

If you’d like to see how a rules-based process could help you apply the principles from this article, you can try Motion Trader with a no-obligation FREE 14-day trial.

👉 Start your free 14-day trial here

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).