Is Vista Group (ASX:VGL) Worth Buying?

Vista Group (ASX:VGL) could be a stock worth buying. It’s an ASX small cap poised to benefit from a return to a more normal way of life. This interview with Jason McIntosh appeared on Ausbiz on 8 April, 2021.

Host: So you’ve got your algorithms looking across the market for price trends. Talk to us about what’s on your radar right now.

Jason: There’s been a lot of talk about all the winners during COVID. We’ve had the Afterpays and tech in general, e-commerce has also been a winner. But I think it’s also interesting to look at some of the stocks that have been left behind, and that have potential to do well over maybe the next 6 to 18 months.

One such stock is a company is a business called Vista Group. This is a New Zealand based company, with a market cap of about $450 million and an ASX listing. The company provides software and technology to the global cinema industry across distribution and exhibition.

Most people wouldn’t have heard of Vista Group. But chances are they would have had exposure to their software by going to the cinema. This is because Vista is a market leader. Their cinema management software has a 38% market share (for cinema businesses in the 20+ screen segment). Exclude China, it’s a 51% market share. And they are active across 110 countries.

I’ll talk more about this in a moment.

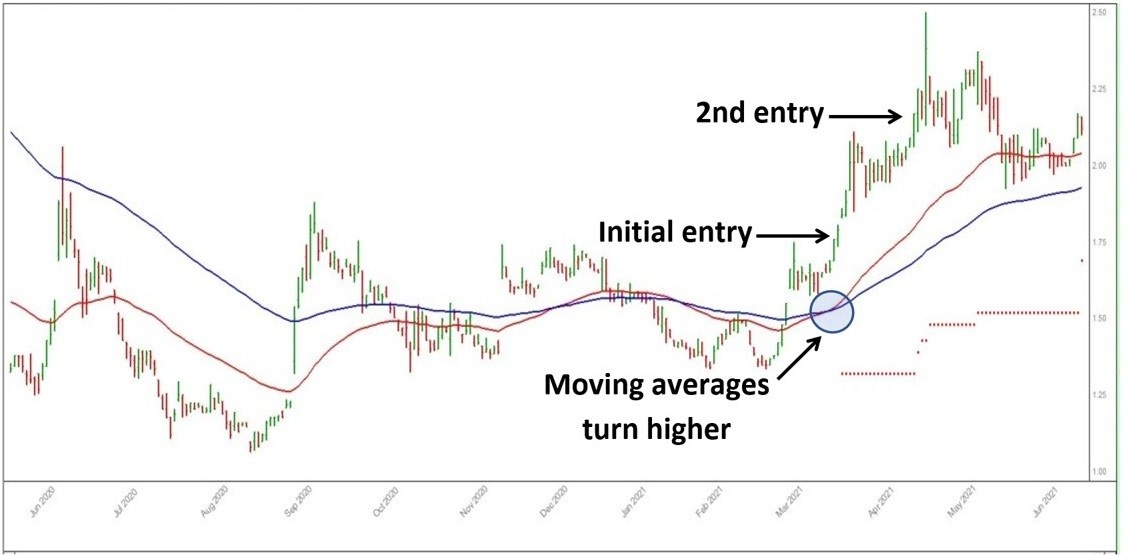

But first, have a look at the chart:

The first thing to note is that the moving averages are rising. This is important, as it shows that momentum is to the upside — the path of least resistance is higher.

Motion Trader’s strategy involves investing in the direction of the trend. You’ll see two entry points on the chart. The dotted line below the moving averages is the trailing exit stop. No matter how compelling a story, an exit strategy is essential for protecting capital.

Getting back to the company…

COVID’s been a disaster for cinema. If the cinemas weren’t shut, they were operating at reduced capacity. There’s also been a lack of top end content with many of the blockbusters being held back. So it’s been a really difficult time for Vista. And this is evident in the results: revenue was off 39% to $88m, and they recorded a net loss of $51m.

But I think what happens from here may be interesting. Firstly, they say that they’ve been able to lock in cost savings. They also say they’ve been able to largely retain their existing client base, as well as bring on new clients. So they appear poised to benefit from a recovery in the industry.

Host: I wonder if perhaps viewing habits have changed, that people are more reluctant to go to the cinema now despite obviously moving, perhaps beyond COVID. Do you think we’re going to reach those same levels? Because I mean the death of the cinema has been on the cards for years, but they managed a bit of a comeback there more recently.

Jason: What’s interesting is that Vista has been a growth story for quite a while. From 2015 to 2019, Vista was increasing revenue each year. It was thought that Netflix and the like would disrupt the cinema industry. But it’s always been resilient. It keeps coming back. People like to go out and do stuff rather than being home all the time. No one knows how we’re going to come back. But even if we just return to some sense of normality, or how normality used to be, there’s probably upside in Vista Group. This stock is really leveraged to a global going back to the way things kind of were.

This stock turned up in my algorithmic scans a couple of weeks ago. It’s potentially in the early stages of turning higher and establishing upward momentum. That’s the first thing I look for when analysing a stock.

Another interesting development has been the arrival of Spheria Asset Management on the share register. They reported a 5.4% interest on 24 February. Spheria specialises in small to mid-cap companies. So Vista is starting to attract attention.

Looking for more “off the radar” stock ideas?

Sign-up for a 30 day trial, and see what an algorithm could do for you.

Click here to start now!