ASX 200 Technical Analysis: Double Breakdown — What It Means for Investors | Episode 307 (November 2025)

By Jason McIntosh | 21 November 2025

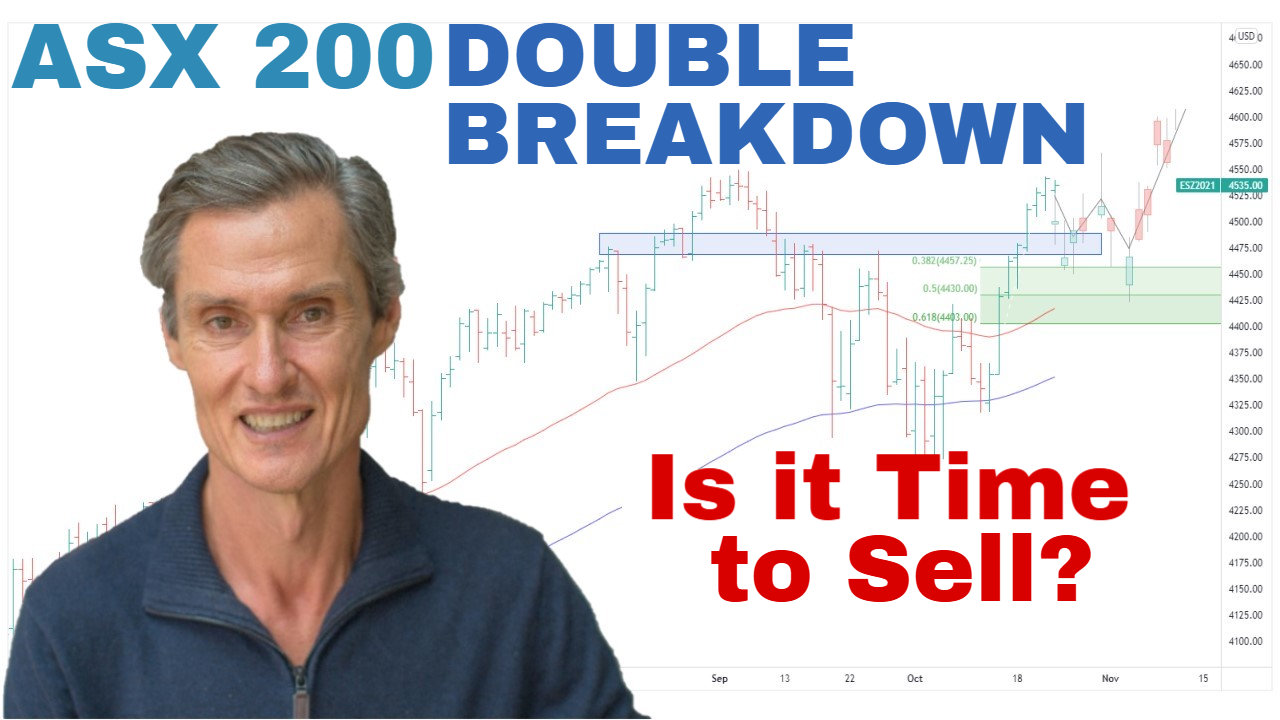

ASX 200 Technical Analysis: Double Breakdown

Quick take: The ASX 200 extended last week’s breakdown, losing 8% from the high and slicing below ~8,600. Moving averages are starting to roll, so it’s time to be alert—but not to panic. The next rebound’s quality (strong reclaim vs. shallow stall) will decide whether this is a deeper consolidation or a reset within the uptrend.

ASX 200 — what changed this week

- Price broke the 8,600 zone (Feb ATH / June high / July support) and sits beneath the 50- & 100-day MAs which are tilting lower.

- What to watch now:

- V-shaped reclaim back above the MAs → constructive reset.

- Muted bounce that stalls beneath MAs → increases risk of another leg down.

- Process, not panic: exits on trailing stops only; avoid wholesale selling on headlines.

Related reading: we buy strength and use rules to manage exits — see

ASX Breakout Strategy and

How to Find ASX Stocks in a Strong Uptrend.

Why the headline index looks worse: financials vs materials

- Financials (heavy ASX 200 weight) lost support, amplifying the fall.

- Materials remain a bullish structure: rising MAs, consolidating after a strong rally, and breaking out of a three-year range. Sustained strength here tempers bearish scenarios for the broader market.

Equal-Weight ASX 200 — context matters

- Pullback of ~7% after a ~37% rally. That scale makes current volatility less surprising. It can evolve lower, but so far it still resembles a pullback after a strong trend, not an established downtrend.

Sentiment check — beware the scary cover

- Fresh mainstream crash headlines echo the old “Death of Equities” moment. Magazine covers capture public fear; they rarely mark ideal sell points. Stay systematic.

U.S. market snapshot

- S&P 500 (cap-weighted): back to the 100-DMA, down ~5% from the high; MAs still broadly rising.

- S&P 500 (equal-weight): broke a two-month range and slipped below MAs—a clear softening in breadth.

- Breadth (Russell 3000 > 100-DMA): fell to ~35%—the zone where moderate pullbacks often bottom. Washouts (mid-teens/20s) are rarer and typically tied to major declines; evidence for that isn’t in place yet.

Bottom line: I’m managing risk—sell at stops, hold leaders with room to move, and let the rebound test tell us more (strong reclaim vs. failed retest under MAs).

👉 For a deeper dive into technical analysis, check out our Weekly Strategy Sessions.

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

Take a Free 2 week Motion Trader trial

Q1: Do moving-average “death cross” headlines mean I should sell?

Not by themselves. Crosses are context-dependent. The rebound quality (strong reclaim vs. stall under MAs) is the higher-signal clue.

Q2: Why is 8,600 important?

It clusters the Feb ATH, June high, and July support. Sustained trading below weakens structure; reclaiming it is constructive.

Q3: Materials are strong but the ASX 200 is weak—what gives?

The cap-weighted index is bank-heavy. Equal-weight and materials suggest a broader pullback, not a full trend break—unless the next bounce fails.

Q4: What would confirm a deeper correction?

A tepid rally that fails beneath the 50/100-DMA on the ASX 200 and Financials, followed by lower lows and rolling MAs.

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).