Jason's Personal Real-Money,

Real-Results Portfolio

Are you looking to double your capital in the next 12 months?

If your answer is “yes”, then stop reading now.

Despite what some people say, astonishing success is rare. And achieving it consistently is even rarer. Those who try, often end up broke.

But if steadily growing wealth interests you, then please read on…

I occasionally get emails from people who are sceptical about Motion Trader.

It gets back to that old question: If it’s so good, why doesn’t he do it himself?

And that’s fair enough.

I always want to know the track record of people advising me. And I don’t expect you to be any different.

It’s fair to expect that if I “talk the talk”, I “walk the walk”.

So let me tell you what I’ve been doing…

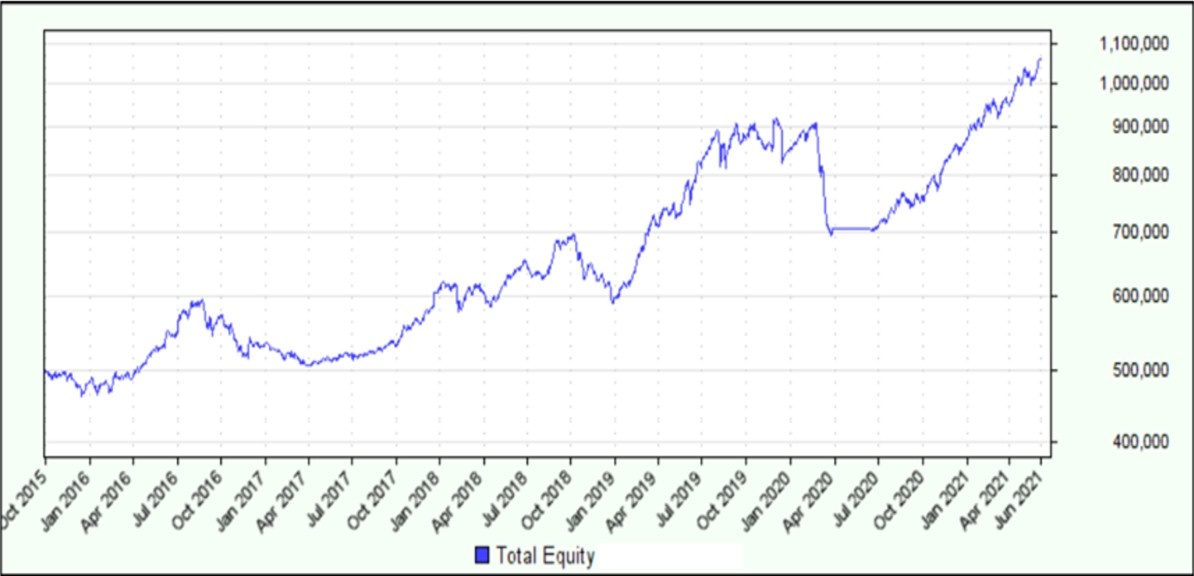

I put $500,000 into a new trading account on 28 September 2015. My aim was to build a real life track record using a system that’s almost identical to what I offer publicly.

You see, I don’t just talk about trading stocks. I actually do it myself. And there’s no better way to show you this than by having a dedicated “Motion Trader” account.

So how’s it all going?

Well, my Motion Trader portfolio is now five years and eight months old.

And what a period it’s been: Collapsing Chinese shares in 2015, interest rate hikes (and cuts), oil prices hitting a record low, escalating trade wars, a pandemic, and a historic market crash.

Here’s how my portfolio has been fairing:

Despite the ominous backdrop, the overall outcome is positive.

As of 1 June, my profit (including dividends and costs) was $675,624 — that’s a total return of 135.1%. Excluding dividends, the figure is 109.6%.

[These numbers haven't been audited, but they are from the figures I provide to the ATO.]

By comparison, the All Ordinaries is ahead by 43.7% over the same period.

My return (ex dividends) is beating the market by a margin of 150.9%.

But it hasn’t been all smooth sailing — it never is.

I’ve had three double digit drawdowns over the past five years. The most recent was due to the COVID crash.

That’s the reality of trading… stocks don’t move higher in a straight line.

The key is to have patience and discipline during the down periods. The investors most likely to come out the other side are the ones who believe in their process, and stick to their plan.

My account’s growth since July 2020 is a case in point.

The more than $300,000 gain wouldn’t have been possible if I’d panicked and abandoned my approach after the collapse.

And remember, this isn’t a simulation or a selection of hand picked examples. The graph closely tracks my pre-dividend portfolio.

So that’s a bit of my story.

And if you’re interest, I want to help you to potentially achieve a similar result.

Next steps

Learn how to identify some of the best stocks to buy in this free video training. You'll learn a complete trading process for buying and selling shares with confidence.

If you're ready to get started, try a no obligation 14-day trial of Motion Trader, and see what a professional trading approach could do for you.