4 Benefits of Investing Your SMSF in Shares

For keen investors, the appeal of self-managed super funds is how much control you have over your investments. You can build a portfolio that reflects your values, interests and financial objectives, and investing in shares is one of the best ways to do that.

Learn how shares can help solidify your SMSF investing strategy.

What is a SMSF?

A self-managed super fund (SMSF) is exactly what it sounds like: a superannuation fund that you control on your own. Instead of putting your cash into a retail or industry super fund, you have complete control over the investments in your portfolio. You get to decide where and when to invest, and how much money you allocate to each investment.

While SMSFs offer a lot of flexibility in terms of investing, trustees must follow rules and regulations set by the Australian Taxation Office (ATO). The biggest one is that you have to prepare and execute a SMSF investment strategy, and review it regularly.

At Motion Trader, we believe this requirement is a good thing. It forces trustees to determine their goals for the SMSF and think carefully about the strategies and investments that can help achieve those returns.

4 benefits of investing your SMSF in shares

You can invest your SMSF in a range of assets, including property and foreign currencies. But shares are among the most popular investments for SMSFs and for good reason.

These are some of the major benefits of using your super to buy shares.

#1. Shares can easily be sold

A big advantage of shares is their liquidity. Typically, there’s a ready market to buy and sell shares during market hours. This means that unlike assets such as property and collectables, you can also reduce your investment if you need to.

For example, say you need cash to fund an unexpected expense, like a medical bill or home repairs. You could potentially sell off some of your SMSF shares and increase your fund’s cash levels, leaving you with the money you need to cover your financial commitment.

#2. Shares have tax advantages

There are a few ways a SMSF can reduce your tax bill:

You can earn credits. The income from many shares is “fully franked,” which means it has a 30% tax credit. But SMSFs only pay a 15% tax rate, which means you can claim the credit and put the difference back into your fund.

You won’t pay taxes on all your capital gains. If you hold onto a share for over a year, only two thirds of your profits will be taxable. Since shares are significant growth assets, that can translate to hundreds or even thousands more dollars in your pocket.

You may qualify to treat your SMSF as a tax-free asset. When SMSF members reach pension age, they become eligible for tax exemptions. This means they no longer need to pay tax on any investment income, including capital gains.

#3. Shares are a great way to diversify your portfolio

Many of the most profitable SMSFs have diverse portfolios, and that’s where shares can help. By investing in a range of shares, you’ll be tying your money to the performance of multiple companies rather than hinging your potential returns on one or two assets.

#4. Shares have high growth potential

When they’re managed well, companies in the right industries offer high growth potential. According to The Rate of Return on Everything (1870-2015) report, the Federal Reserve Bank of San Francisco calculated the equity returns for 16 countries and discovered Australian shares returned 7.57% in the 65 years since 1950 (after inflation).

The ASX provides investors with the opportunity to invest in over 2,000 businesses. Many of these are likely to grow significantly in the future. If you need help with identifying high growth potential stocks, our free video training series may help.

What SMSF shares can you invest in?

Before we go into the types of shares you can invest in, note that you can only purchase shares on the stock exchange through a broker or online platform. You can’t purchase shares from other members in off-market transfers.

With an SMSF, you’re free to invest in both Australian and international shares, making your options almost unlimited.

Australian shares

Many SMSF members choose to invest in ASX-listed companies, paying special attention to growth stocks, like Xero (XRO) and AfterPay (APT). You could also invest in popular, commonly-traded Australian shares, such as Woolworths (WOW) and Telstra (TLS).

Smaller companies can offer significant growth potential. Many of the ASX’s biggest companies began as smaller businesses, and investors who identified these stocks at an earlier stage benefited from their growth. If smaller companies interest you, we can help.

International shares

Investors can also buy shares in individual global companies that aren’t listed on the ASX, but feature on markets like the New York Stock Exchange or London Stock Exchange. Along with adding another level of diversification to your portfolio, this also allows you to tap into growth opportunities beyond the Australian market. Some of the best shares for SMSFs could include big-name global companies, like Alphabet (GOOG), Amazon.com (AMZN) and Apple (AAPL).

3 of the best SMSF investment tips

Managing a SMSF is an ongoing commitment, and these tips should help set you up for success in the short- and long-term.

#1. Invest according to your risk tolerance

SMSFs can potentially be high-risk, high-return products, so it’s essential to have a risk management strategy in place. Before making an investment, consider each member’s life circumstances and how comfortable they are with risk.

For example, if your SMSF is made up of young members in the workforce, you may have room to invest in riskier growth assets. But if your members are older and close to retirement, you’ll likely want to assume less risk and adjust your portfolio accordingly.

The reason is simple. High-growth assets may perform well over time, but they’re often prone to greater volatility, making them an unsuitable option for some investors.

#2. Monitor the financial markets

Remember, you have full control over your SMSF — but this also means you have full responsibility over the results of your investments. To ensure your SMSF is successful, you need to do your research and stay on top of what’s happening in various financial markets.

If you’re planning to invest in Australian shares, track the local share market’s performance over recent years. Try to identify trends and patterns to help determine which ASX shares offer the best potential relative to the risk you’re prepared to accept. And if you need to adjust your strategy, that’s fine. In fact, the ATO stipulates that members must regularly review their investments.

The same approach applies for international markets. Make sure you consider the potential return relative to the risk. Many people only think about an investment’s upside. But it’s important to understand what could happen if prices fall.

#3. Diversify your portfolio as much as possible

You’re technically allowed to invest 100% of your fund in shares, but this often isn’t advisable. Your regulator may expect your strategy to involve investing in a broad range of assets. The goal is to give yourself the greatest opportunity for returns, so consider allocating money to various asset classes.

The best SMSF investments could include:

- Cash, in the form of savings accounts and term deposits

- Collectibles, such as art and antiques

- Commodities, like coffee and corn

- Corporate or government bonds

- Derivatives, like CFDs

- Fixed interest securities

- Forex

- Precious metals, such as silver and gold

- Residential of commercial property

- Unlisted or listed property trusts

Get professional help with your SMSF investments

If you’d like to learn how to identify ASX stocks with a high potential for growth, register for our free video training. In the step-by-step video, we explain the process many leading investors use to construct successful share portfolios — and you can use these strategies to build your SMSF portfolio from the ground up.

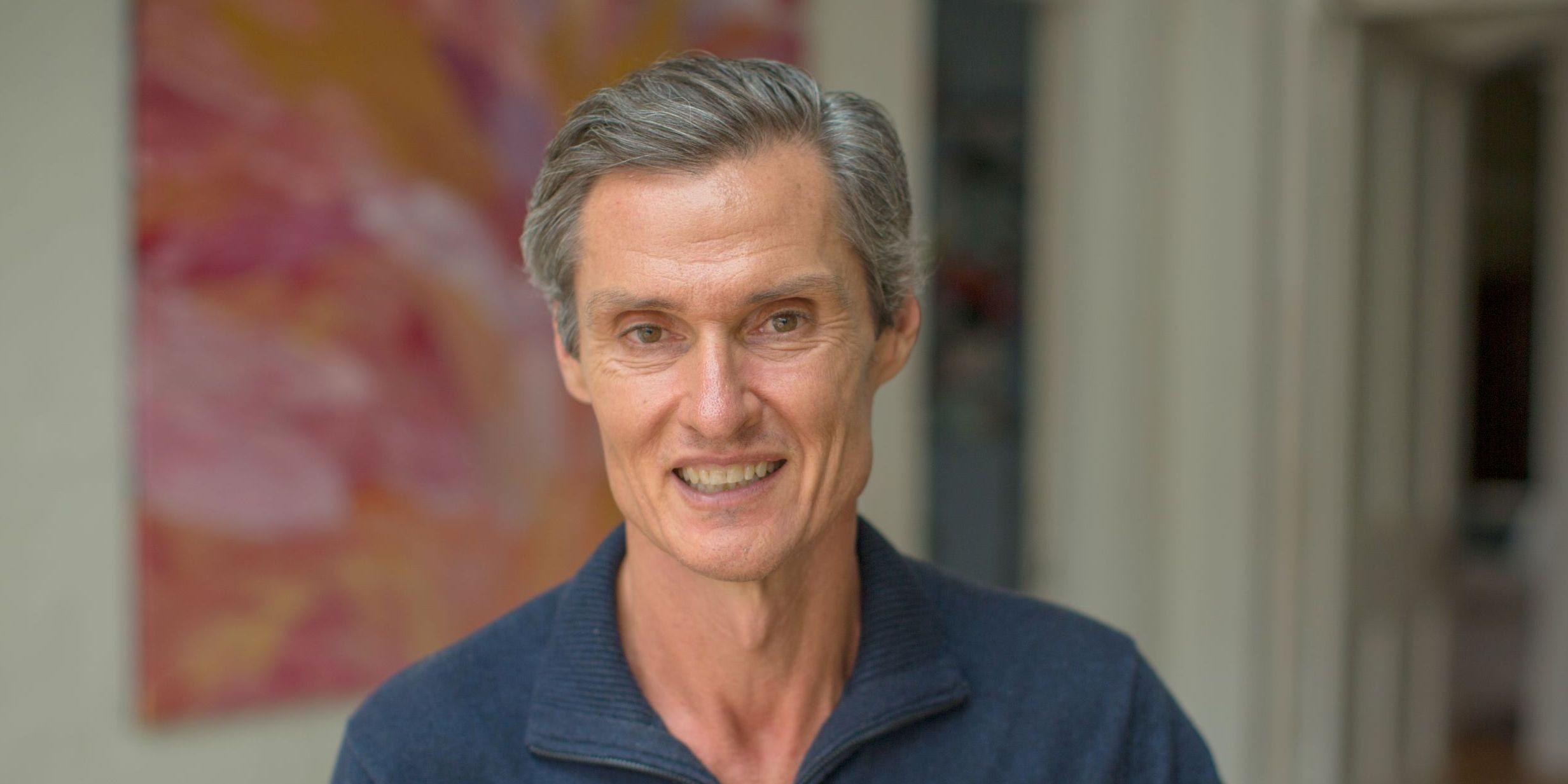

Meet Jason

I'm Jason McIntosh, the creator of Motion Trader. My career began in 1991 on the trading floor at Bankers Trust. Nowadays, I trade my own systems from home in Sydney.

Motion Trader is for investors who value robust analysis, data driven entry and exit signals, commentary, and education. I use engineered algorithms to identify when to buy and sell ASX stocks. No biases or guesswork, just data driven signals.