ReadyTech (ASX:RDY) Is Set for a Digital Transformation

By Jason McIntosh | Published 29 July 2021

Jason McIntosh explains why ReadyTech Holdings (ASX:RDY) could be a technology company to buy now. In addition to having a growing SaaS platform, a recent acquisition opens a significant new growth channel. This interview appeared on the Ausbiz financial news channel on 30 July, 2021.

Host: Jason, tell us about ReadyTech.

Jason: One of my favourite parts of the day is doing my daily scans of the ASX. It’s always fascinating to see some of the names that come up — often for stocks I’d never heard of before.

ReadyTech is a case in point…

The company has a market cap of about $240 million. It’s not in the All Ordinaries, so you probably won’t see it in the business pages. This makes it practically unfindable for many people.

But that needn’t be the case.

You see, a rising share price can help you identify stocks like ReadyTech. It draws your attention to situations others miss. You could say that momentum is opportunity’s calling card.

So, what does ReadyTech do?

The company is a provider of cloud and SaaS-based payroll and human resource software systems. It targets the education and employment sectors and has over 4,000 customers ranging from small businesses to large employers.

If you don’t know, SaaS refers to “software as a service”. Instead of downloading software, the user accesses an app via the internet. The software is centrally hosted and licensed on a subscription basis.

And demand is growing for ReadyTech’s services…

The company reported revenue growth of 13.4% to $21.8 million in the first half. Underpinning this was a combination of winning new customers and cross-selling to existing ones.

An advantage of the SaaS model is that it generates recurring revenues. These recurring streams make up 89% of the company’s total revenue, and were up 15.6% in the half.

But a recurring revenue model is only effective if customers stick around. This doesn’t seem to be an issue to ReadyTech, with customer revenue retention of 95%. It’s also encouraging that average revenue per customer was up 22.3% to $11,800.

Managements says that a digital transformation is taking place, and that customers are increasingly switching from old technologies to cloud based services.

ReadyTech is also growing through acquisition. The company recently purchased Open Office — an integrated software business servicing state and local government, as well as the justice system.

Governments and global justice markets are digitising services at records rates. A migration to cloud and SaaS platforms is also occurring. This provides Open Office with a big opportunity for growth.

It’s interesting to note that Open Office has been winning pitches against the larger Technology One [ASX:TNE] (market cap of $2.9 billion). I believe this indicates plenty of growth potential.

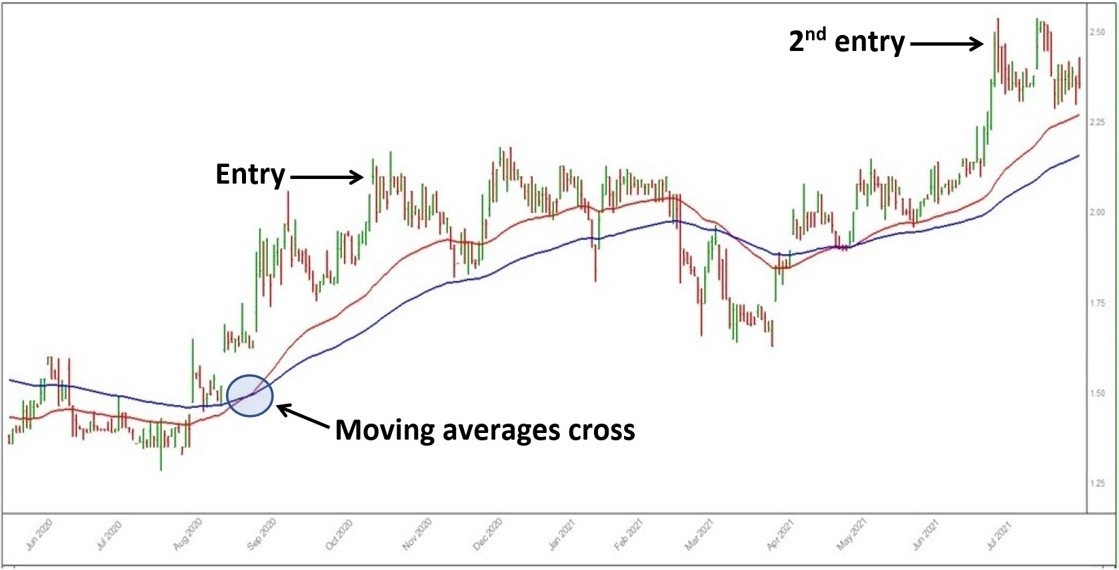

This is what the chart looks like:

Motion Trader’s strategy is to buy as prices are rising (note the moving averages were moving upwards). This helps improve the odds of success — the path of least resistance is up.

I sent a buy signal to members of my Motion Trader service at $2.12 in October. And with the shares recently breaking to a new high, I’ve just put out a second buy on the stock.

ReadyTech has high growth potential over the next few years. I believe the shares could rise significantly from current levels.

Finally, management have been buying shares over the past year. They collectively own around $20 million worth of stock, or roughly 9% of the company. I always like to see management backing a business with their own funds.

Where to invest now?

Looking for ASX stocks to buy now, as well as off the radar ideas most people don’t know? Our algorithms scan the stock market daily for medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

If you’re ready to get started, try a no obligation 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.